Great Mortgages. The Right Insurance. Expert Advice.

What the economists are saying about April’s job numbers

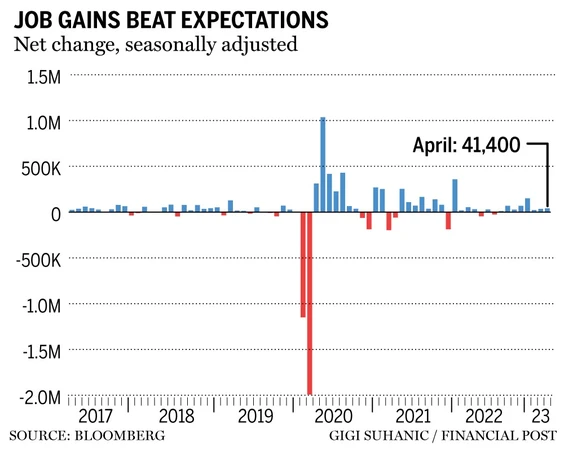

Canada added 41,400 jobs in April, beating the consensus forecast of Bay Street economists for a gain of 20,000, according to new data released by Statistics Canada on May 5.

“Once again, the Canadian jobs market surprises to the upside,” James Orlando, an economist at Toronto-Dominion Bank, said in a note.

There were other surprises. The jobless rate held at five per cent, when Bay Street was expecting an increase, and average hourly wages rose 5.2 per cent from April 2022, beating estimates for a slowdown to 4.8 per cent.

It wasn’t all to the upside, though. “If there were flies in the ointment, it was that all of the gain and then some was in part-time positions,” David Rosenberg, lead economist at Rosenberg Research & Associates Inc., said in a note to clients.

Part-time jobs rose 47,600, with self-employment accounting for roughly half of that. Meanwhile, full-time employment fell 6,200 positions, the first drop since August 2022.

Otherwise, Rosenberg said there was plenty for the Bank of Canada to dislike about the report, including an unemployment rate stuck at five per cent for the fifth straight month and strong wage growth — all pointing to a “tight” labour market.

Bank of Canada governor Tiff Macklem said on May 4 he needs to see the jobs market “rebalance” to bring inflation back down to the bank’s two per cent target rate.

Still, some economists said the April report delivered signs that the tightness was easing. Several said the country’s surging population is changing the way the data should be assessed. Canada’s population grew by one million last year. In March and April, it expanded by a further 152,000 people aged 15 and up, said Nathan Janzen, an economist at Royal Bank of Canada.

“The supply of workers has been boosted, enabling firms to put a big dent in the number of job vacancies,” said Orlando at TD.

Here’s what economists are saying about the jobs report and what it means for the Bank of Canada:

James Orlando, Toronto-Dominion Bank

“The BoC won’t change its policy stance based on this report. The inflow of new Canadians is changing the calculus on what a standard jobs report looks like. The fact that the unemployment rate has been stable means that we may have reached a new steady state. This means that the ‘surprise’ employment report isn’t adding the same labour market tightness as it would have in the past. Plus, the BoC can always focus on the lack of breadth in sector hiring and the fact that this print was driven by part-time employment, with full-time employment going negative. All told, the BoC’s position on the sidelines is probably more stable following today’s release.”

Veronica Clark, Citigroup Global Markets

“A very strong 41k increase in employment in April, a low unemployment rate unchanged at 5.0 per cent, and stronger than expected wage growth above 5 per cent YoY all support our base case that the BoC will raise rates again when it meets next month. Strong employment growth, even if fuelled by factors like immigration, will imply the economy remains in excess demand for longer than the BoC expects. Wage growth, one of the BoC’s four key inflation metrics to watch, remains stable around 4-5 per cent, levels too high to be consistent with 2 per cent inflation. Markets continue to under-appreciate the BoC’s commitment to raising rates again if inflation appears persistently too high. We suspect the BoC will have seen enough in economic data by the June meeting to conclude that conditions since their pause in January point towards rates needing to rise slightly further.”

Nathan Janzen, Royal Bank of Canada

“For now, labour markets look very firm, and continued to surprise broadly on the upside in April. But growth headwinds from aggressive interest rate hikes over the last year continue to build, with tightening credit conditions in the U.S. adding to downside risks. With growth concerns building, the Bank of Canada is likely done hiking interest rates. But labour markets are too strong and inflation still running too hot to justify a quick shift to cuts. We expect the BoC to remain on hold for the rest of this year.”

David Rosenberg, Rosenberg Research

“Like the Fed, the BoC will not like the tighter tone to the labour market and the growth in wages, which is running above levels that would be consistent with price stability.

“The sector and regional composition was very lopsided and the data have to be viewed in the context of Canada’s immigration boom, which has helped lift monthly population gains so far this year to +70,000 or nearly double the norm. But the fact of the matter is that the labour market remains tight, wage growth is above where the Bank of Canada would like to see it from a ‘two per cent inflation target’ point of view, and all this means that the futures market is moving towards pricing in a summertime BoC rate hike.”

Arlene Kish, S&P Global

“Canada’s job market is not signalling a looming recession. April’s uneven labour market results do suggest there is a growing uneven performance across the country and within industries. While this is not what was originally anticipated by economists when the Bank of Canada began monetary policy tightening, especially as the unemployment rate steadily remains at a low rate, signs of softening labor demand are emerging. Job shake-ups in the retail trade industry abound, and job losses are being reported within the technology industry. Therefore, bumpy labour trends should continue in the near term as economic demand conditions soften. Based on the April Labour Force Survey results, the Bank of Canada will keep interest rates unchanged at the June 7 policy announcement.”

Charles St-Arnaud, Alberta Central

“A robust labour market and strong wage growth are a challenge for the Bank of Canada. As we have explained on numerous occasions, the BoC needs to slow growth and create some excess capacity in the economy to fight inflation. This will likely lead to a rise in the unemployment rate and job losses. With this in mind, continued strength and tightness in the labour market may not be a welcomed outcome for the BoC. Moreover, the central bank is becoming increasingly concerned with the disconnect between strong wage growth and weak labour productivity.

“The continued resilience of the labour market and the strength in the economy in the early part of 2023 led the BoC to consider increasing its policy rate at the April meeting. However, whether the BoC hikes further depends on inflation and the growth outlook, especially in light of weak growth in the second quarter. Moreover, the continued banking woes in the U.S. and Europe suggest caution is warranted, as the BoC may need to balance fighting against inflation and increased financial stability risks.”

Douglas Porter, Bank of Montreal

“The robust headline job gains are no doubt being flattered by strong underlying population growth, and all of last month’s rise was of the part-time variety. Nevertheless, the key point is that there is no evidence that the labour market is softening at all, lending important support for the broader economy. If this persists through the spring, the Bank of Canada may yet be forced to rethink its rate pause, especially with the housing market showing signs of reviving. All eyes will now turn to the next inflation report (CPI, May 16), which needs to continue slowing to keep the Bank on the sidelines.”

Karl Schamotta, Cambridge Mercantile

“The monetary policy implications are surprisingly unambiguous: the Bank of Canada is likely to remain on hold, with still-elevated underlying inflation pressures and relatively robust economic activity levels adding to strong employment growth in supporting the case for keeping policy restrictive, even as sentiment and credit creation measures point to an imminent slowdown. This should narrow the gap between U.S. and Canadian yields on the front end, and help push the Canadian dollar decisively through the 1.35 mark against the greenback — even as weaker oil prices add drag.”