Get a Quote

Select one of the following products:

A residential mortgage is a loan that one or more people receive, in order to buy a house, condo, or other residential property which they will either live in or rent out to others. The loan is secured by a lien (mortgage) on the property and the borrowers are required to repay the loan over a specified period of time.

At Outline Financial we have direct access to over 30 banks, credit unions, and mono-line lenders, and offer a wide range of rates and options to help you compare and secure the best mortgage in Ontario or nation-wide for your needs. Some of the primary residential mortgage services we offer include:

- Pre-approvals

- Purchases

- Renewals or transfers

- Refinance or equity take out mortgages

- Construction/renovation mortgages

- Vacation/secondary home mortgages

- New build condo mortgages

- Investment property mortgages

- along with a host of other Specialty Mortgage Programs

Why Choose Outline Financial for Your Next Residential Mortgage?

With access to more than 30 lenders including banks, trust companies, credit unions, and mono-line lenders, we deliver some of the best mortgage rates the market has to offer – but landing the right residential mortgage is about far more than rates alone.

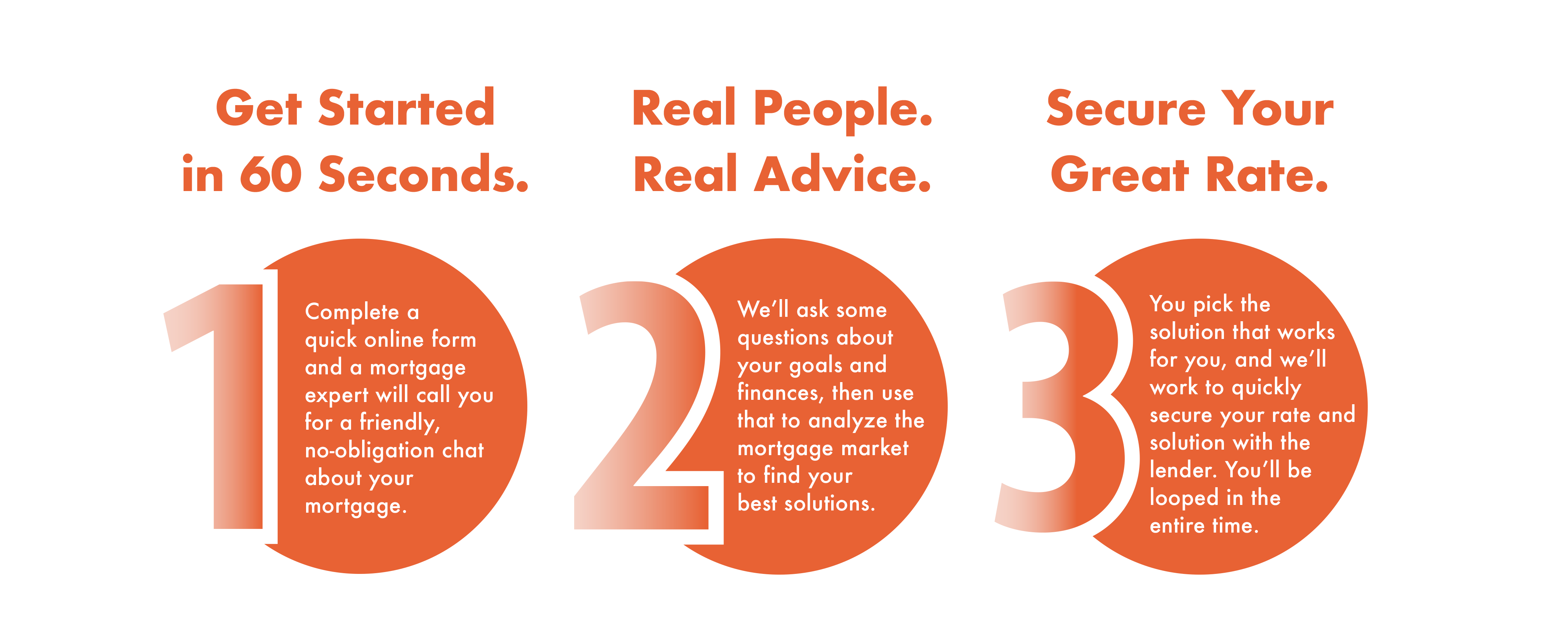

Whether you’r purchasing your dream home or an investment property, the Outline Experience is designed to deliver effective advice to help you secure a mortgage quickly and seamlessly as possible, then pay it off in a timeline that meets your goals.

Perhaps most importantly, we’ll guide you through all stages of the process, ensureing you understand every detail and work with a network of other professionals-from real estate agents to accounts and laywers- to address your unique needs along the way.

Benefits of Working with Outline Financial?

- Professional Mortgage Advisors

- Rates from 30+ Lenders

- Exceptional Guidance & Advisory

- Customer-Focused