Great Mortgages. The Right Insurance. Expert Advice.

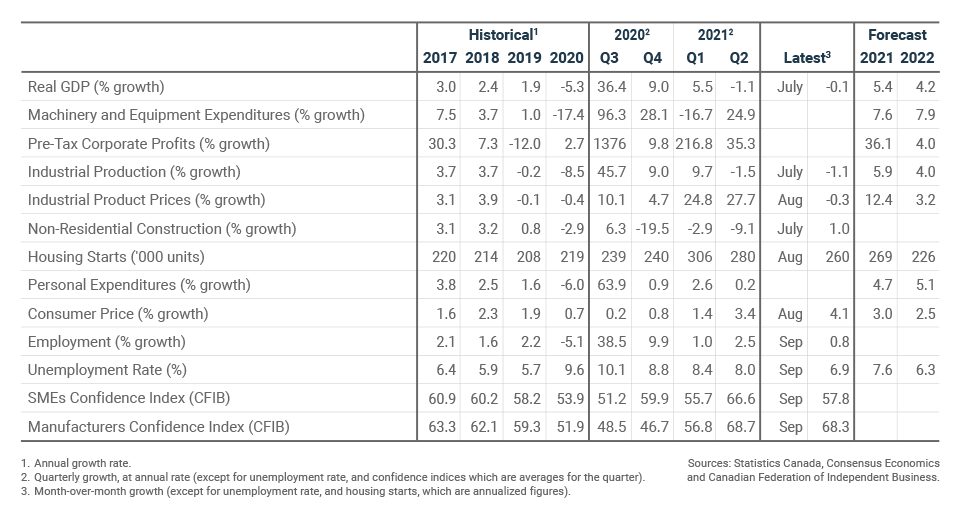

Key Economic Indicators

BDC Economic Letter – October 2021

The Business Development Bank of Canada (BDC) Source article can be found [HERE]

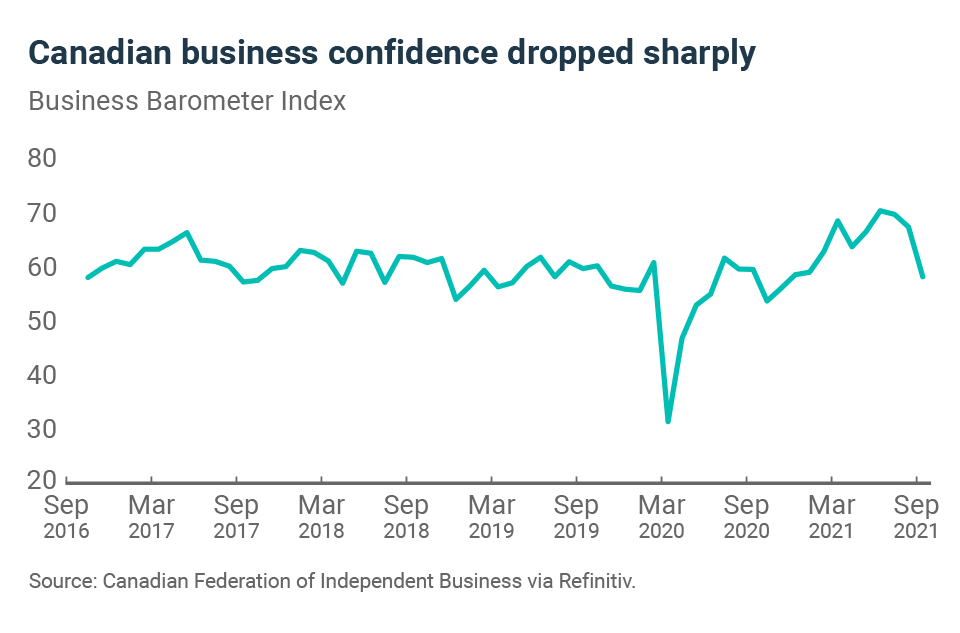

Bank of Canada’s job is getting harder

The recent slowdown in economic activity and the accumulation of challenges facing businesses do not suggest a strong likelihood of a change in monetary policy by the Bank of Canada on October 27. The issue is becoming more challenging for the central bank, however, as inflation expectations continue to accelerate and labour market conditions favour wage growth.

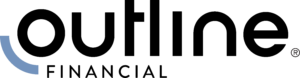

Opposing forces should maintain a stable loonie

The Canadian dollar fell from US$0.80 in early September to less than US$0.78 about 20 days later. This drop was mainly due to the uncertainty that was generated by the federal election. Since Election Day, the loonie has effectively resumed its upward trend and is starting the fourth quarter just above 79 cents. The most recent price increases in energy markets, including oil, could push the Canadian dollar higher, but the rising uncertainty in the U.S. is mitigating this risk so far. The balance of these effects suggests that the CAD will remain stable against the USD at around 0.80.

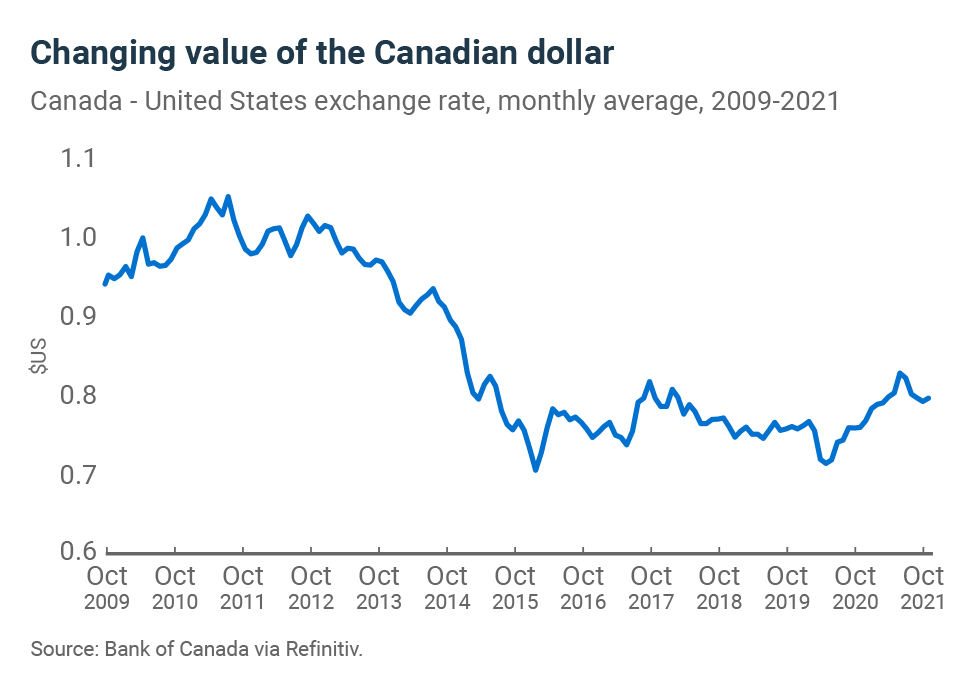

Pessimism is back among Canadian SME

Uncertainty in Canada rose following the start of the federal election campaign in mid-August. According to the Canadian Federation of Independent Business, this was the main reason for the sharp drop in the business barometer index in September. Confidence among Canadian business leaders dropped nearly 10 points in a single month. The index fell from 67.1 in August to 57.8 in September. This is the worst result for the index since last November when an effective vaccine for COVID-19 was still unannounced and the country was dealing with the second wave of the virus.

Inflationary pressures: the transition is getting longer

Cost pressures continue in this country. In addition to the so-called base effect, many economists agreed that the inflation of the past few months was transitory. That is because the price growth is the result of a temporary imbalance between limited supply that has been unable to meet the high demand generated by the pandemic and the various health measures imposed around the world to deal with it over the past 18 months. While these multiple imbalances should eventually resolve themselves, the timing of their correction seems to be getting worse each month. New pressures are also emerging as supply shortages spread across new sectors of the economy. In addition to pressure on material costs, pressure on wages is also increasing as companies once again face labour shortages. Inflation may therefore prove to be hold longer than initially anticipated.