Great Mortgages. The Right Insurance. Expert Advice.

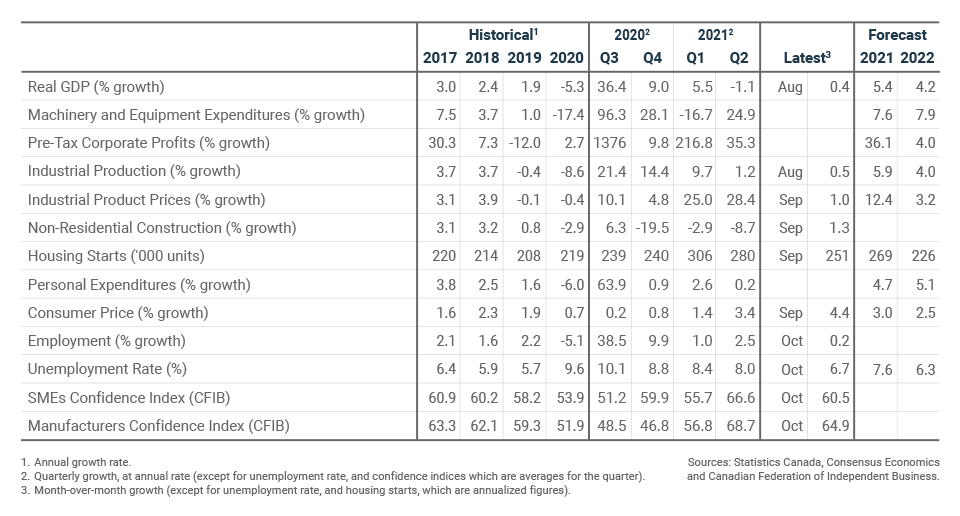

Key Economic Indicators

BDC Economic Letter – November 2021

The Business Development Bank of Canada (BDC) Source article can be found [HERE]

Change of course at the Bank of Canada

On October 27, the Bank of Canada announced that it was completely ending the massive asset purchase program initiated more than a year and a half ago to support the economy through the COVID-19 crisis. In his speech, the Governor also stressed that although inflation is due to transitory factors, it will remain above the target range for longer than the Bank had initially anticipated. He thus opened the door to a rate hike as early as April 2022. It is important to note that the Bank of Canada’s announcement came out just days before the release of gloomier data regarding the economic recovery.

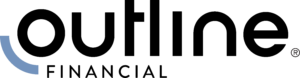

Loonie went down recently

The Canadian dollar rose to around US$0.81 following the announcement of the Bank of Canada that it would possibly tighten the monetary policy earlier. For several weeks now, high energy prices, including oil, have supported the appreciation of the Canadian dollar against its U.S. counterpart. October’s U.S. inflation hit a 30-year high and the possibility of the American government adding barrels to the market from the strategic reserve to soften prices have both disadvantaged the CAD more recently. The loonie has fallen back slightly below the 80-cent mark.

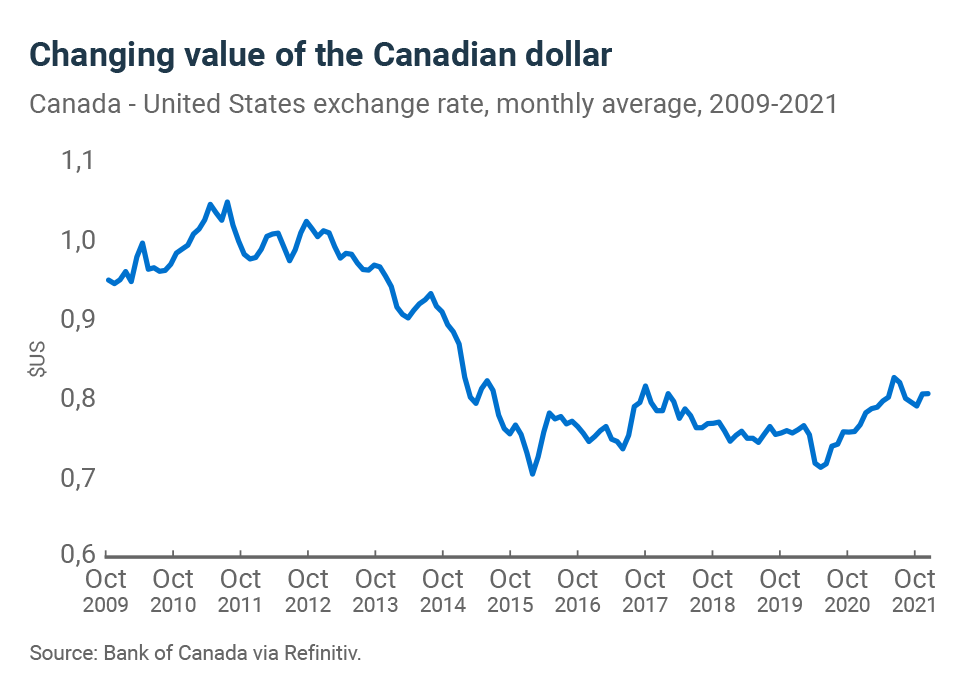

Business confidence is still low

The Canadian Federation of Independent Business (CFIB) argued that the election had created uncertainty among Canadian entrepreneurs. This explained the sharp drop in the Business Barometer index in September. With the election behind us, confidence among Canadian SMEs barely improved in October. The long-term index, which measures business optimism over a 12-month outlook, rose from 57.8 in September to 60.5 in October. The short-term index remains below 50 (at 45.5), meaning that business owners expecting their companies’ performance to deteriorate in the next three months outnumber those that expect it to improve.

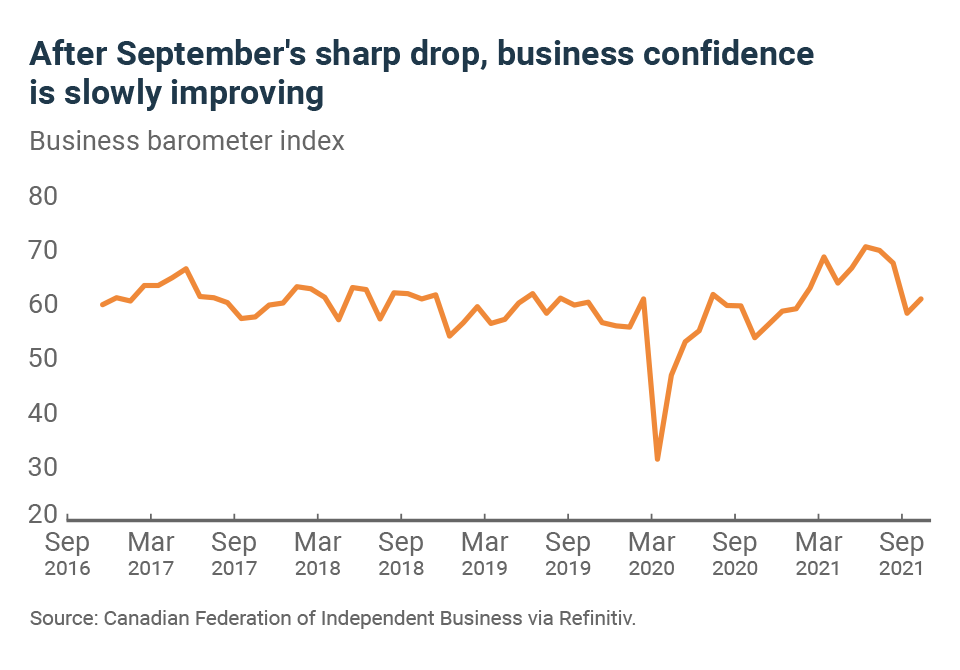

The cost of doing business is increasing

Input costs are rising in this country. Whether it is physical capital or labour, production costs are rising due to supply chain problems, container shortages, labour scarcity and high energy prices. Now financing costs are also increasing. The effective interest rate for businesses has risen to the level reached in July 2020, which is close to 2.5%. Of course, credit terms remain attractive and affordable at such low rates. However, the trend is upward and the tightening of monetary policy by the Bank of Canada should continue to put pressure on financing costs in the future.