Great Mortgages. The Right Insurance. Expert Advice.

How Economists And Markets Are Reacting to June’s Inflation Data

The Globe and Mail – July 2024

The Globe and Mail – July 2024

Money markets have increased their bets that the Bank of Canada will cut interest rates again on July 24 in the wake of this morning’s modestly tamer-than-expected June inflation data.

Implied probabilities of future interest rate moves in swaps markets now suggest a 92 per cent chance of a Bank of Canada quarter-point rate cut at that policy meeting, up from 83 per cent odds just prior to the 8:30 am ET report, according to data from LSEG. Nearly three more quarter-point cuts are now priced into markets by the end of this year, which would bring the bank’s overnight rate to 4 per cent.

Currency markets also interpreted the data as dovish, with the Canadian dollar dropping about two-10ths of a cent following the data, to 73.00 cents US. Bond market reaction was fairly subtle, with Canada’s two-year bond yield holding close to 3.8 per cent, nearly unchanged for the session. That partly reflected a stronger-than-expected U.S. retail sales report that was released at the same time, which put upward pressure on North American bond yields.

Coming into this month, probabilities for an interest rate cut on July 24 were essentially down to a coin flip. But several economic reports since then – most notably a weak June Canadian jobs report – had markets increasingly pricing in a July 24 quarter-point rate cut by the BoC. Several economic reports and dovish Federal Reserve market commentary out of the U.S. in recent days also now have markets nearly fully pricing in a Fed rate cut in September – which has raised confidence levels further that the BoC will soon cut rates a second time.

Canada’s annual inflation rate cooled a tick more than expected to 2.7 per cent in June, largely due to softer growth in gas prices, while core inflation measures were marginally down. Analysts polled by Reuters had forecast the inflation rate would tick down to 2.8 per cent from 2.9 per cent in May.

Month-over-month, the consumer price index was down 0.1 per cent, compared with a forecast for no change. This was the first deceleration in the monthly inflation rate since December, Statistics Canada data showed.

Here’s how implied probabilities of future interest rate moves stand in swaps markets, according to data from LSEG as of 1007 am ET. The Bank of Canada overnight rate is 4.75 per cent. While the bank moves in quarter point increments, credit market implied rates fluctuate more fluidly and are constantly changing. Columns to the right are percentage probabilities of future rate moves.

And here’s how markets were pricing in monetary policy changes just prior to the data being released:

The majority of economists and market strategists also believe a rate cut now looms for next week. Here’s how they are reacting in written commentaries this morning, which includes Bank of Montreal economists changing their forecast to now calling for a July rate cut:

David Rosenberg, founder of Rosenberg Research

The May bump in Canada’s CPI was an aberration, pure and simple, and that assertion was supported by the just-released June data where the headline price level (not seasonally-adjusted) dipped -0.1% versus the +0.1% consensus estimate. This helped pull the YoY trend lower to +2.7% from +2.9%. Remember — the BoC, unlike the Fed, does not have a strict 2% inflation target, per se, but rather a range of 1% to 3%, and we are now moving comfortably within that band. More rate cuts are coming, July 24th and thereafter, and if the Canadian dollar becomes a casualty, so be it. …

I keep saying that the one underlying CPI measure that is near and dear to the Bank of Canada’s heart is the CPIX, which excludes the 8 most volatile components as well as indirect taxes. This came in at a puny +0.1% MoM, as it has done (or lower) in six of the past seven months. The YoY trend in this non-noisy price metric has been cut to +1.9% from +3.2% a year ago and +6.2% two years ago. That is a trend indeed! So is the fact that the six-month pace is running well below “target” at a mere +1.3% annual rate.

Then when you take out mortgage interest costs (what is that doing in the CPI, anyway?), inflation in Canada is running at +1.9%. The ex-shelter CPI has gone from +2.0% a year ago to +1.25% presently. All roads lead to the same conclusion: the BoC is far from done, given how far the policy rate is above any definition of “neutral” — try at least 200 basis points left in the tank in this easing cycle that is now in its infancy stage.

Royce Mendes, managing director and head of macro strategy, Desjardins Securities

After the prior month’s detour, inflation was back on a track towards the Bank of Canada’s 2% target in June. … The inflation reading for Q2 of 2.7% is notably below the Bank of Canada’s forecast of 2.9% for period.

Core measures of inflation looked significantly tamer in June relative to May. Excluding food and energy, prices were up a more trend-like 0.2% in seasonally-adjusted terms, leaving the twelve-month pace of that measure at 2.9%, within the central bank’s control range. The Bank of Canada’s core measures of inflation also showed signs of progress, with median and trim both increasing 0.2% during the month. That saw the year-over-year rates of both metrics slow. While the three-month annualized rates did accelerate, they tend to be volatile and won’t be enough to scare central bankers off cutting rates on July 24th.

A return to tepid consumer price growth likely seals the deal for a follow up 25bp rate cut from the Bank of Canada next week. Along with significant declines in inflation expectations and a further normalization in corporate pricing behaviour, the latest inflation data build a strong case for continuing the rate cutting cycle without delay. That’s particularly true in light of the subdued survey responses from consumers and businesses about the outlook for the Canadian economy.

Stephen Brown, deputy chief North America economist, Capital Economics

The Bank of Canada’s preferred CPI-trim and CPI-median measures of core prices rose at an above-target monthly pace for the second month running in June. Nonetheless, with the Bank’s Business Outlook Survey, released yesterday, pointing to much more disinflationary pressure in the pipeline, we still think the odds favour another interest rate cut next week.

CPI-trim and CPI-median each rose by 0.24% m/m, above the rate of 0.17% that would be consistent with 2% inflation, but smaller than the average gain of 0.33% in May. The Bank can also take some encouragement from trends in the other key price indices, with CPIX – which excludes eight of the most volatile components – rising by just 0.1% and headline prices also rising by just 0.1%. …

As the closely watched three-month annualised change in CPI-trim and CPI-median picked up further to 2.9% in June, we can’t completely rule out a pause from the Bank next week. Our sense, however, is that the Bank is likely to be growing more concerned about the downside risks of its still tight policy stance. The unemployment rate jumped to 6.4% in June and the Business Outlook Survey suggests that wage pressures have eased considerably, all of which should give the Bank confidence that core inflation will continue to fall.

James Orlando, director and senior economist, TD Economics

Today’s CPI report was a bit of a mixed bag. While headline inflation got back on track in June, the three-month annualized pace of core inflation has now been rising for three straight months. This infers that the annual pace of inflation should remain in the upper end of the BoC’s 1% to 3% range over the coming months. This has been propelled, not just by shelter prices, but also by price gains in “nice-to-haves” like the cost of dining out, health spending, and household operations.

The BoC is set to make a rate announcement next week and today’s report has increased odds of back-to-back rate cuts. Recent data have supported a cut, with the job market loosening and wage gains decelerating from elevated levels. From our view, the story hasn’t changed. The BoC is in a cutting cycle. Whether or not it follows through with a slightly quicker pace of cuts next week, Canadians should expect rates to be steadily reduced over the rest of this year and next.

Matthieu Arseneau and Alexandra Ducharme, economists with National Bank Financial

Some may argue that June’s pace is still too high (2.9% annualized) to reach the 2.0% target. Given that the recent trend is far from eyebrow-raising, we would be surprised if the Bank of Canada is concerned. Indeed, over the last six months, core inflation has been running at a rate of only 2.2%, barely above the central bank’s target, while a very small number of components are rising at a rate above the target. We’ve been arguing for some time that Canada’s widespread inflation problem has long been solved and is limited to the shelter component. All we have to do is remove the mortgage interest component, whose rise is largely attributable to the Bank of Canada itself, and annual inflation is only 1.9%, compared with 2.7% for the basket as a whole. And it’s not as if there’s any indication that inflation will accelerate in the coming months, quite the contrary. The labour market is deteriorating rapidly, as evidenced by the rising unemployment rate in recent months, while hiring is failing to keep pace with population growth. Yesterday’s Business Outlook Survey confirms our view that most industries are currently overstaffed, which is hardly reassuring for the future. In fact, the proportion of firms reporting labour shortages fell to 15%, a level seen only in previous recessions. What’s more, a large majority of companies are planning to give smaller pay rises than last year, which will help to bring down inflation excluding housing. All in all, this morning’s data is consistent with our view that the Canadian economy is in great need of oxygen and we still expect a rate cut in July.

Derek Holt, vice-president and head of capital markets economics, Scotiabank

The Bank of Canada’s core inflation gauges were hot again in high frequency m/m terms last month. Two back-to-back months of hot core gauges support my thesis that the first four-month period this year was a transitory soft patch for inflation and now we’re bouncing back from it. The BoC is still likely to cut next week, but choosing to do so would put full faith in the BoC’s sketchy forecasting abilities while casting aside data dependency and fresher information on the evolving shock to global supply chains that may matter to a trade dependent country like Canada. It’s also probably true that had the BoC not cut in June and pre-committed to “several” more cuts, then it might have been optically harder to do so now. …

The proper way to look at the core gauges is to consider the m/m SAAR [seasonally adjusted annual rate] readings. They were hot again. Both trimmed mean and weighted median CPI were up by 2.9% m/m SAAR following the prior month’s 4.1% readings for both. … Underlying inflation has pivoted higher again over the past two months. It’s not screaming hot like it was earlier in the post-pandemic period, but it’s hot enough to merit concern that inflation risk remains alive and kicking in Canada. …

Several arguments work in favour of continued easing.

- The BoC has relatively shifted toward its confidence that macroeconomic rebalancing will sustainably achieve 2% inflation into next year. We’ll see, but that’s their bias.

- Macklem has sounded extremely dovish. Not close to the limit of undershooting the Fed and doesn’t care about the currency while guiding that expecting “several” rate cuts is reasonable. I doubt he would have said that in reference to next year since we’ll deal with that when we get there.

- The BoC delivers fresh forecasts next week. After jumping the gun on a cut in June against his own guidance, to whiff when they present an updated forecast that targets achieving 2% would be pretty bizarre in terms of the lagging effects.

Katherine Judge, senior economist, CIBC

The inflation data for June gave the Bank of Canada what it needed in order to cut interest rates at next week’s meeting. The headline CPI decelerated by two ticks to 2.7% y/y, in line with the consensus expectation. But more important for policymakers, their preferred measures of core inflation, CPI-trim and CPI-median both showed a monthly advance of 0.2% (seasonally adjusted), down from a 0.3% pace in the prior month. Other key core measures also improved, with CPIX decelerating to a 0.1% m/m pace, and CPI ex. mortgage interest costs at 1.9% y/y. This shows that the prior month’s upside surprise in inflation was just a blip in a broader trend of disinflation as demand in the economy remains under pressure, paving the way for a BoC cut next week.

Benjamin Reitzes, managing director, Canadian rates and macro strategist, BMO

The details of the report are consistent with the backdrop of consumers becoming increasingly cautious with discretionary spending. There was notable softness in recreation and clothing. A steep 11.1% drop in travel tours, continuing the extreme volatility in the category, weighed on recreation. Clothing was weaker across the board. Shelter also came in on the soft side, with rent seeing the smallest increase (+0.1%) in nearly two years, and a drop in utilities providing a helping hand.

However, there were some challenging aspects, as food prices perked up for a second consecutive month (+0.6% seasonally adjusted), which followed four months of flat-to-lower prices. Insurance costs are also accelerating, with auto insurance up 8.1% y/y (four-year high) and home insurance up 9.2% (though down a tick from the prior month).

Key Takeaway: The June CPI came in on the soft side continuing the slow but steady march toward the 2% inflation target. Taken with the softer Business Outlook Survey, consistently rising jobless rate, and persistent below potential growth, the June inflation report was just good enough for us to change our call for next week’s Bank of Canada meeting to a 25 bp rate cut.

Claire Fan, economist, Royal Bank of Canada

June’s CPI print was a small relief after an upside surprise in May. …The Bank of Canada’s preferred CPI trim and CPI median both dropped lower on a monthly basis although the narrower “supercore” measure held slightly higher. Yesterday’s second quarter release of the BoC’s Business Outlook Survey largely confirmed further normalizing in a few key areas that the central bank has deemed critical to future inflation trends, including firms’ pricing behaviour, their expectations for inflation in the future as well as wage growth. All told, we expect the BoC will carry on with easing the monetary brakes on a weak economy, and follow up with another rate cut at its July meeting next week.

Tu Nguyen, economist with assurance, tax & consultancy firm RSM Canada

June’s inflation report confirms that the Canadian economy is firmly on a disinflationary trajectory as headline inflation drops to 2.7% due to slower growth in gasoline prices and core inflation measures see little change.

Shelter inflation – the most stubborn category – is showing signs of slowing thanks to the increased supply of new condos in the market. There was no surprise in the data as all categories saw inflation stay steady.

We believe that the Bank of Canada should cut the policy rate by 25 basis points next week, bring the policy rate to 4.5%.

Inflation is on track to reach 2.5% this year and return to 2% next year. Keeping the policy rate unnecessarily restrictive risks a policy error and raises recession odds. In addition, disinflation south of the border points to a Fed rate cut in September, which limits the divergence in the policy rates between the Bank and the Fed.

Philip Petursson, chief investment strategist, IG Wealth Management

We believe the focus for the Bank of Canada will have to shift from inflation – which we would argue they have already won the fight – to the economy. From the labour market perspective we are seeing a continued deterioration of conditions. Last month’s employment report was nothing short of disappointing. The unemployment rate continues to climb higher and currently stands 1.6% higher than it was at the low of July 2022. The economy is now losing full time jobs replacing them with part time. The quality of the labour market is weaker today. Canadians are coming under stress from multiple directions of interest rates (in the form of higher mortgage rates), the remnants of higher inflation, and a weaker labour market. The Bank can no longer take the attitude of only one ailment at a time. It now needs to weigh the risks of interest rates against not just inflation, but the Canadian economy as a whole. We believe the BoC will have to place more emphasis on the economy and as such, follow through with its next interest rate cut coming next week followed by two more cuts in the fall.”

Nick Rees, FX Market Analyst, Monex Canada (foreign exchange firm)

The Bank of Canada should cut rates later this month based on June’s CPI figures. Today’s data confirms that May’s inflation uptick was a blip, whilst the balance of economic risks looks increasingly skewed to the downside. If anything, expectations ahead of today’s print were distinctly unambitious, with markets only anticipating price growth of 0.1% MoM in June. This latest data managed to undershoot even this low bar – aggregate prices fell outright, declining by -0.1% last month. All told, this left inflation running at 2.7% YoY, fully reversing May’s upside surprise. Placed against the backdrop of a weak labour market, soft economic growth, and the BoC’s business outlook survey for Q2 that pointed towards sustained downward pressure on inflation going forwards, today’s figures should be the last piece in the puzzle ahead of the BoC’s meeting next week. All indicators suggest that inflation is on its way back to target and rates that are, if anything, too tight – we think a July rate cut should now be a done deal for the Governing Council.

Bryan Yu, chief economist, Central 1 credit union

With an economic slowdown in play due to risks from the mortgage renewal wave, declining per capita GDP, and unemployment rates expected to go higher, it is appropriate to cut given past hikes are still flowing through the economy. Wage growth remains an upside risk for inflation as it flows through service prices, but slack in the labour market should tame increases over time.

What Does This Rate Drop Mean For You?

If you have a variable rate mortgage with adjustable payments:

- You will see a decrease in your payment of about $15 per $100K of mortgage depending on your amortization.

If you have a variable rate mortgage with static/non-adjustable payments:

- The interest portion of your payment will decrease and more of the payment will go towards the principal (unless you have already hit your trigger point).

If you have a home equity line of credit:

- Your minimum payment will decrease by about $20 per $100K of HELOC balance.

If you have a fixed-rate mortgage:

- There is no immediate change, although it could positively impact your renewal options.

If you are currently shopping for a home or have a pre-approval?

- Your buying power may have increased. If your approval rate is reduced by 0.25%, it could increase your purchasing power by about 2.5%, all else being equal (i.e., if you were buying for $1,000,000, it’s possible you may now qualify for approximately $1,025,000).

- What if you have a fixed rate pre-approval? As fixed rates typically move in tandem with bond yields (which move in anticipation of a Bank of Canada rate change), the 0.25% drop by the Bank of Canada was already priced in most fixed rates. That being said, if we see a continued expectation of further rate reductions, expect bond yields to gradually decrease as the rate cuts become more imminent (this will be particularly true for shorter-term products).

What Does This Rate Drop Mean For You In The Longer Term?

Are higher home prices on the way?

- As rates drop, buying power increases. While the 0.25% rate reduction doesn’t make a huge mathematical difference, it could make a huge psychological difference to home buyers looking to beat the potential rush if rates fall further. As illustrated in the attached chart [click here], you can see that from April 2004 to April 2024, a reduction in interest rates has typically been followed by a period of increasing average prices within the Greater Toronto Area.

Is this the first of more rate cuts to come?

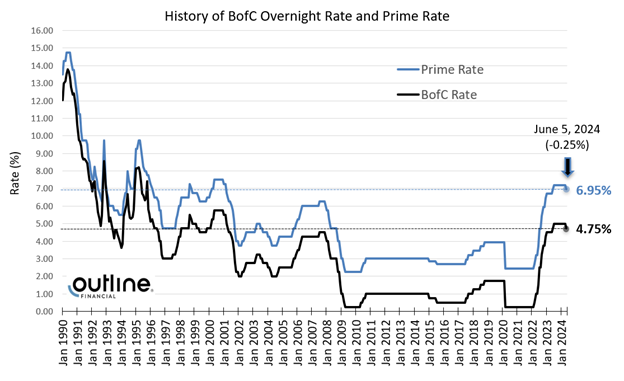

- The short answer? Yes, very likely. As of the time of writing, most economists & banks are projecting another 1.00% to 1.50% of rate reductions by the end of 2025. While the timing of future rate reductions is uncertain, if inflation continues to cool, and the economy stays in check, the Bank of Canada can continue its march downward. For reference, the Bank of Canada defines an overnight rate of between 2.25% to 3.25% as the “neutral rate” for the economy (i.e., an overnight rate that is neither expansionary nor contractionary for the economy). Given that the current overnight rate is 4.75%, there is potentially another 1.50%+ of rate reductions to go, to bring the overnight rate into neutral territory.

Fixed or Variable?

- As the overnight rate (and prime rate) drops, the potential attractiveness of a variable vs. fixed rate product grows. During March 2024, variable rate mortgages accounted for just over 12% of all mortgage originations. Expect this number to increase as the 10-year average is closer to 25%. Looking to weigh your options? At Outline Financial, we have developed a number of analysis tools to help quantify the pros, cons, costs, and benefits when comparing your fixed vs. variable options.

How Will This Impact Fixed Rates?

- As mentioned above, fixed rates are heavily influenced by government bond yields. Given that bond yields move “in anticipation of” a potential Bank of Canada rate change, the 0.25% rate reduction was already priced in most fixed-rate approvals. That being said, if we see a continued expectation of further rate reductions, expect bond yields to gradually decrease as the rate cuts become more imminent (this will be particularly true for shorter-term products).

Why Did the Bank of Canada Lower Rates?

While countless articles will be written about the June 5th Bank of Canada (BofC) rate cut, we’ve included some key takeaways below, along with links to the Bank of Canada press release as well as the opening statement from Tiff Macklem (Governor of the Bank of Canada).

Links to the press release and opening statement:

- Bank of Canada, June 5th press release [click here]

- Opening statement: Tiff Macklem (Governor of the Bank of Canada) [click here]

Why did the Bank of Canada decide now was the time to reduce rates?

- “With continued evidence that underlying inflation is easing, Governing Council agreed that monetary policy no longer needs to be as restrictive and reduced the policy interest rate by 25 basis points” – BofC press release

- “We’ve come a long way in the fight against inflation. And our confidence that inflation will continue to move closer to the 2% target has increased over recent months. The considerable progress we’ve made to restore price stability is welcome news for Canadians”. – Tiff Macklem opening statement

The Bank of Canada acknowledges further rate reduction may be on the way, but will take it one meeting at a time:

- “If inflation continues to ease, and our confidence that inflation is headed sustainably to the 2% target continues to increase, it is reasonable to expect further cuts to our policy interest rate. But we are taking our interest rate decisions one meeting at a time.”- Tiff Macklem opening statement

- “We don’t want monetary policy to be more restrictive than it needs to be to get inflation back to target. But if we lower our policy interest rate too quickly, we could jeopardize the progress we’ve made. Further progress in bringing down inflation is likely to be uneven and risks remain.” – Tiff Macklem opening statement

When are the next Bank of Canada rate announcements?

- July 24 – (Interest rate announcement and Monetary Policy Report)

- September 4 – (Interest rate announcement)

- October 23 – (Interest rate announcement and Monetary Policy Report)

- December 11 – (Interest rate announcement)

For more details about the 0.25% Bank of Canada rate cut, or to discuss which rate or product options might be right for you, please contact a member of the Outline Financial team as we are always on standby to help.