Great Mortgages. The Right Insurance. Expert Advice.

Canadian Economy at a Glance

BDC Economic Letter – November 2021

The Business Development Bank of Canada (BDC) Source article can be found [HERE]

Economic recovery under stress

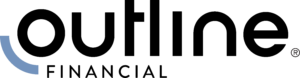

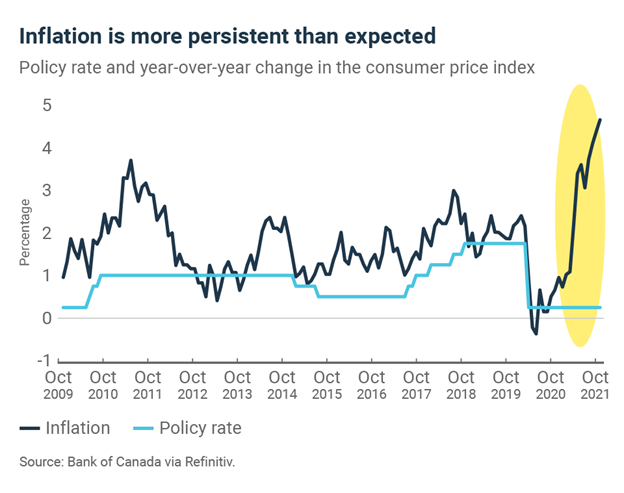

The Canadian economy grew by 0.4% in August, with 15 of 20 sectors continuing to recover from the COVID recession. Preliminary data suggests anemic growth in September. If these expectations come to pass, Canada’s economy would have grown at an annualized rate of 1.9% in the third quarter, well below expectations.

The economy would then be running at 98.6% of its pre-pandemic peak at the start of the fourth quarter. At this rate, full GDP recovery will not be achievable by the end of the year.

More than 30% of the GDP growth in August was attributable to the accommodation and food services sector. Manufacturing and retail sales also contributed positively to the country’s economic recovery in August after July slowdowns.

Change of course for the Bank of Canada

In late October, the Bank of Canada sent shockwaves through the markets. Governor Tiff Macklem announced a complete end to the Bank’s quantitative easing program and a possible acceleration of rate hikes as early as April 2022.

This announcement came just days before the release of GDP data. While Statistics Canada expects growth of just 2% in the third quarter, the Bank of Canada forecasted a 5.5% increase for the quarter in its latest monetary policy report. Given this gap, it would be surprising to see the first interest rate hike as soon as April, but the Bank of Canada’s main concern remains inflation.

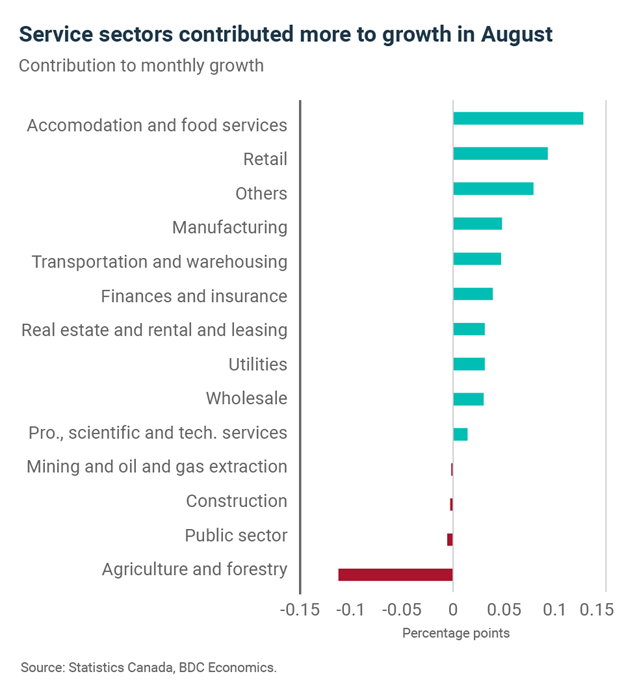

The trend in the consumer price index will now be the focus of future monetary policy decisions. In October, inflation reached 4.7%. This is the seventh consecutive month above the Bank’s target range (between 1 and 3%).

Pandemic still weighs on economic outlook

Last November, the first announcement of an effective vaccine against COVID-19 created renewed optimism around the world. One year later, we still cannot claim victory over the pandemic, but the situation has certainly improved. Half of the world’s population has received at least one dose of COVID vaccine.

In Canada, the fourth wave induced by the Delta variant is gradually fading and will not have affected the reopening of the Canadian economy too much. However, despite a high vaccination rate (75% of the population fully vaccinated) and the continued reopening, economic activity is still being adversely affected by the pandemic, which is moderating growth and pushing up prices.

Higher inflation is being driven by a surge in energy prices, a rebound in demand for services such as air travel, and of course, supply constraints. These inflationary pressures, which are considered transitory, are weighing more heavily on the outlook and will last longer than initially estimated by the Bank of Canada.

Households remain in good shape

Households hold the key to a strong economic recovery—disposable income and excess savings continue to rise from already high levels.

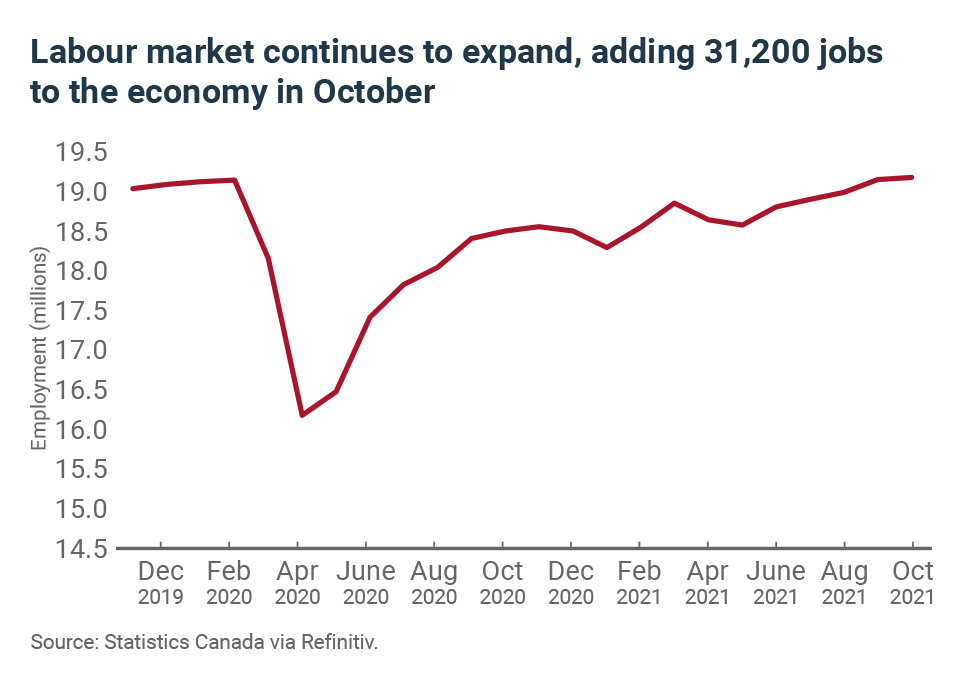

Consumption and residential investment should remain strong, despite the withdrawal of some federal transfers, amid healthy job gains. After creating more than 157,000 jobs in September to bring employment to full recovery from the pandemic, the economy added another 31,200 jobs in October.

Employment gains will prove more challenging in the coming months even though the unemployment rate is still at 6.7% (one percentage point above the February 2020 level).

Bottom Line

- Sectors most affected by health restrictions continue to rebound, but overall the recovery has stalled.

- Households are in a good position to continue supporting growth as employment continues to rise. But inflation is reducing consumers’ purchasing power.

- Inflationary pressures may continue longer than the Bank of Canada had anticipated and it has indicated it is prepared to raise interest rates to keep prices under control. Financing conditions will tighten in 2022; try to take advantage of low rates to finance your projects while there is still time.