Great Mortgages. The Right Insurance. Expert Advice.

Canadian Economy at a Glance

BDC Economic Letter – December 2021

The Business Development Bank of Canada (BDC) Source article can be found [HERE]

The ups and downs of the Canadian economic recovery

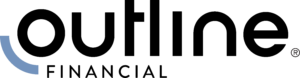

Surprisingly strong economic activity in the third quarter still wasn’t enough to propel the Canadian economy above its pre-pandemic level.

GDP growth reached an impressive 5.4% annualized in the quarter. Yet, GDP still stood at only 98.6% of the pre-pandemic level. This is because a contraction in the spring was worse than Statistics Canada had previously estimated. GDP actually fell by 3.2%, not 1.1%.

Despite this revision, there is no denying economic activity picked up strongly over the summer, thanks to reopenings and relaxed health restrictions. Household consumption and exports more than offset a decline in residential investment.

For the third quarter as a whole, the majority of sectors in Canada experienced positive growth (13 out of 20). The majority of the gains came from high-contact services, especially the accommodation and food services industry (+27.7% from Q2). The goods sector as a whole contracted by 0.9% during the period.

Manufacturing should improve slowly

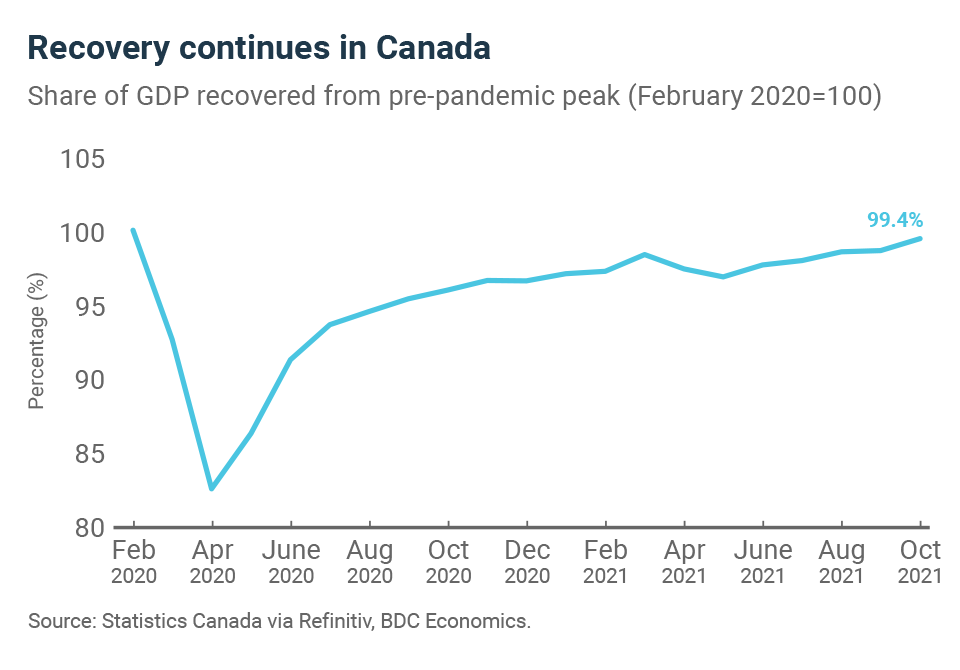

A preliminary analysis by Statistics Canada suggests that economic activity grew by 0.8% in October. This growth appears to have been fairly widespread, but particularly strong in manufacturing.

The performance of the manufacturing sector has been rocky to say the least in recent months. A shortage of semiconductors has been a major contributor to its difficulties, including a 1.7% decline in September. As automotive and aircraft parts production picks up, the sector should begin to contribute positively to economic activity again.

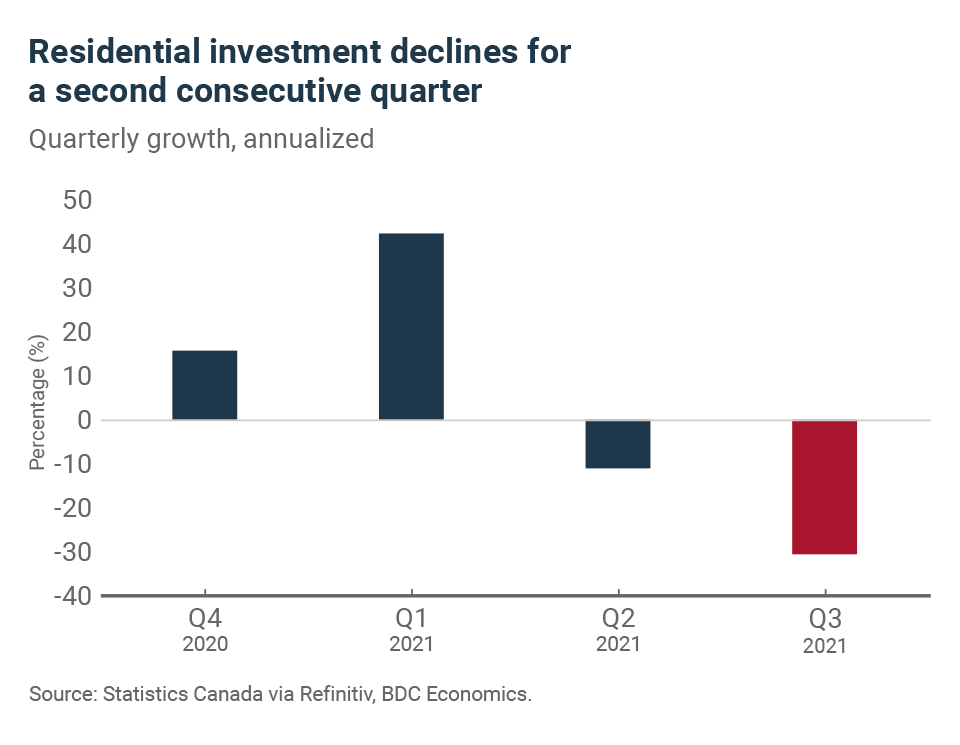

Trouble in the residential sector

Rising real estate prices are both a cause and a consequence of the decline in residential investment (-31% in the third quarter). Stimulated by low interest rates and the need for more space due to the rise in telecommuting, strong demand pushed up real estate prices across Canada in 2021.

With very little inventory of homes for sale, prices have skyrocketed. Today, some buyers are discouraged by high prices while others simply can’t find what they need.

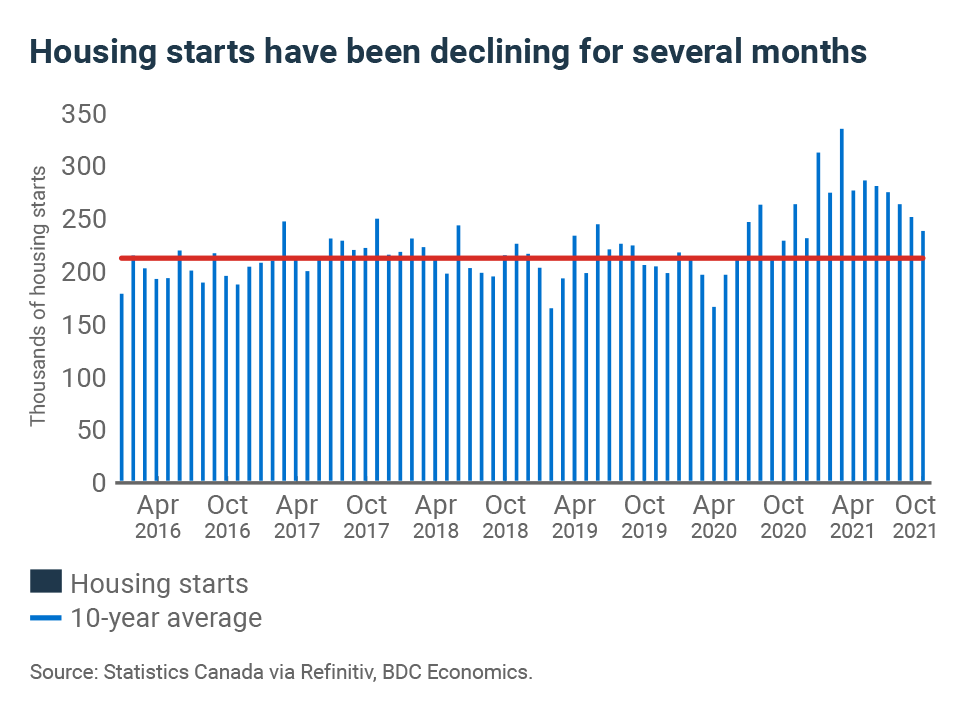

The decline in residential investment is also reflected in the construction industry (-3.9% in Q3). While housing starts remain high by historical standards, they continued to fall in October.

Demand for renovation projects is also slowing due to delivery delays caused by supply chain bottlenecks and the reallocation of household budgets to services. However, the residential real estate craze could pick up momentum again in the coming months as some households rush to finance their projects before interest rates rise.

More employment gains

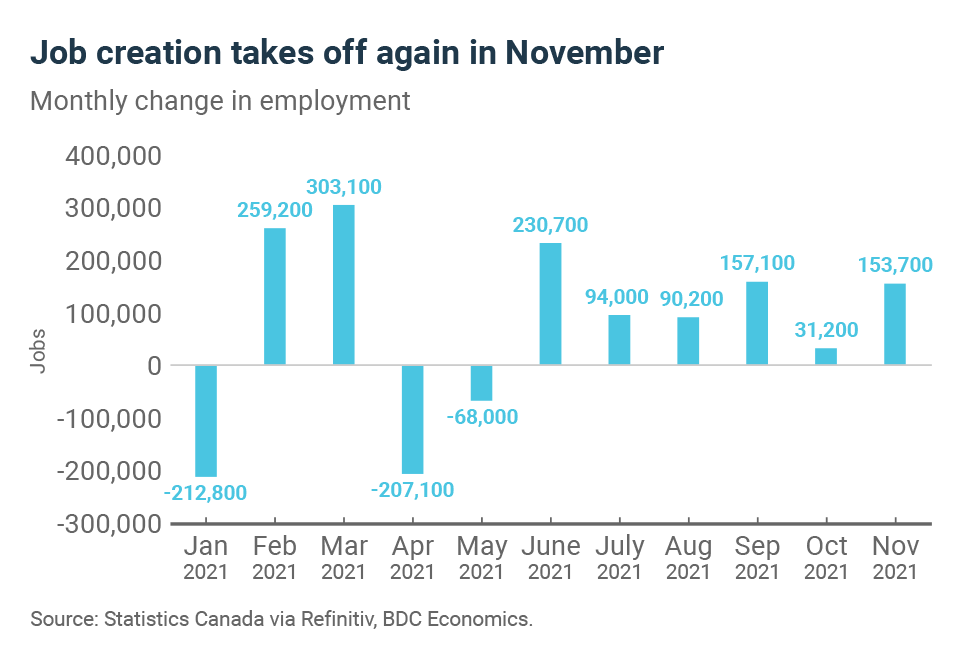

In November, 154,000 jobs were created across the country. The pace of job creation has rebounded sharply from October. Since September, employment has fully recovered its pre-crisis level. November’s impressive gains have propelled the employment level well above that February 2020 peak.

Many employers continue to have difficulty recruiting staff. In September, there were over one million jobs available in Canada. This suggests that the skills of potential workers do not match those needed by businesses. Despite all this, the unemployment rate at 6.0% remains above the pre-pandemic low.

Bottom Line

- Despite the strong performance in the third quarter, there is still a long way to go before we return to pre-pandemic levels of economic activity. The supply side of the economy is still under pressure, but households are in a good position to support the economy. The evolution of the new Omicron variant could, however, cloud the economic outlook in the short term.

- Employment continues to grow across the country and is making it increasingly difficult to recruit workers. Available workers may not be exactly what you are looking for. Consider developing an internal training program to adequately equip new employees.

- Manufacturing and residential housing slowed in the face of the headwinds, but the latter could be headed for a rebound. Households and businesses should move ahead with their investment plans ahead of an expected 2022 interest rate hike.