Great Mortgages. The Right Insurance. Expert Advice.

The Bank of Canada announces another 0.25% reduction. What could this mean for you?

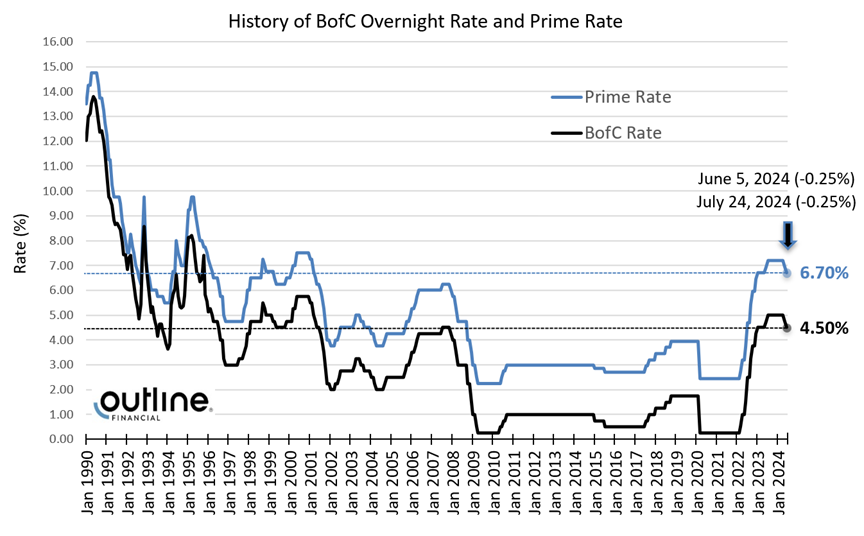

On June 24th, 2024 the Bank of Canada announced another decrease in its overnight target rate. This is the second 0.25% reduction in a span of just 50 days (“50 bps in 50 days”), bringing the overnight rate to 4.50% and the prime rate to 6.70%.

If you currently have a mortgage, or if you are looking to purchase a home, here is what the combined 0.50% of rate drops over the past 50 days could mean for you:

What could this rate drop mean for you in the short and long term? We dive into the details below, or read our formatted report by clicking [here].

What Does This Rate Drop Mean For You?

If you have a variable rate mortgage with adjustable payments:

-

You should see a decrease in your payment of about $30 per $100K of mortgage depending on your amortization.

If you have a variable rate mortgage with static/non-adjustable payments:

-

The interest portion of your payment will decrease and more of the payment will go towards the principal (unless you have already hit your trigger point).

If you have a home equity line of credit:

-

Your minimum payment should decrease by about $40 per $100K of HELOC balance.

If you have a fixed-rate mortgage:

-

There is no immediate change, although it could positively impact your renewal options.

If you are currently shopping for a home or have a pre-approval?

- Your buying power may have increased. If your approval rate is reduced by 0.50%, it could increase your purchasing power by about 5.0%, all else being equal (i.e., if you were buying for $1,000,000, it’s possible you may now qualify for approximately $1,050,000).

- What if you have a fixed rate pre-approval? As fixed rates typically move in tandem with bond yields (which move in anticipation of a Bank of Canada rate change), the recent rate drops by the Bank of Canada were already priced in most fixed rates. That being said, if we see a continued expectation of further rate reductions, expect bond yields to gradually decrease as the rate cuts become more imminent (this will be particularly true for shorter-term products).

What Does This Rate Drop Mean For You In The Longer Term?

Are more rate cuts expected?

- The short answer? Yes, very likely. As of the time of writing, most economists & banks are projecting another 1.00% to 1.50% of rate reductions by the end of 2025. While the timing of future rate reductions are uncertain, if inflation continues to cool, and the economy stays in check, the Bank of Canada can continue its march downward.

- For reference, the Bank of Canada defines an overnight rate of between 2.25% to 3.25% as the “neutral rate” for the economy (i.e., an overnight rate that is neither expansionary nor contractionary for the economy). Given that the current overnight rate is 4.50%, there is potentially another 1.25%+ of rate reductions to go, to bring the overnight rate into neutral territory.

Fixed or Variable?

- As the overnight rate (and prime rate) drops, the potential attractiveness of a variable vs. fixed rate product may grow. During May 2024, variable rate mortgages accounted for only 8% of all mortgage originations**, while fixed rate mortgage terms shorter than 5 years accounted for 80% of originations, and fixed rate mortgage terms of 5 years or more accounted for 12% of originations. Expect the percentage of variable rate mortgages to increase as the 10-year average is closer to 25%.

- Looking to weigh your options? At Outline Financial, we have developed a number of analysis tools to help quantify the pros, cons, costs, and benefits when comparing fixed vs. variable or mortgage term options.

**Mortgage Origination Data Source: Bank of Canada – Funds advanced for new lending by chartered banks across Canada.

How Will This Impact Fixed Rates?

-

As mentioned above, fixed rates are heavily influenced by government bond yields. Given that bond yields move “in anticipation of” a potential Bank of Canada rate change, the most recent 0.25% rate reduction was already priced in most fixed-rate approvals. That being said, if we see a continued expectation of further rate reductions, expect bond yields to gradually decrease as the rate cuts become more imminent (this will be particularly true for shorter-term products).

Why Did the Bank of Canada Lower Rates?

While countless articles will be written about the July 24th Bank of Canada (BofC) rate cut, we’ve included some key takeaways below, along with links to the Bank of Canada press release, monetary policy report, as well as the opening statement from Tiff Macklem (Governor of the Bank of Canada).

Links to the press release and opening statement:

- Bank of Canada, July 24th press release [click here]

- Opening statement: Tiff Macklem (Governor of the Bank of Canada) [click here]

- Monetary Policy Report: The Bank of Canada’s Montary Policy Report PDF and Video [click here]

Why did the Bank of Canada decide now was the time to reduce rates?

- “With broad price pressures continuing to ease and inflation expected to move closer to 2%, Governing Council decided to reduce the policy interest rate by a further 25 basis points.” – BofC press release

- “This decision reflects three key considerations. First, monetary policy is working to ease broad price pressures. Second, with the economy in excess supply and slack in the labour market, the economy has more room to grow without creating inflationary pressures. Third, as inflation gets closer to the 2% target, the risk that inflation comes in higher than expected has to be increasingly balanced against the risk that the economy and inflation could be weaker than expected.” – Tiff Macklem opening statement

The Bank of Canada acknowledges further rate reduction may be on the way, but will take it one meeting at a time:

- “If inflation continues to ease broadly in line with our forecast, it is reasonable to expect further cuts in our policy interest rate…we will be taking our monetary policy decisions one at a time.” – Tiff Macklem opening statement.

When are the next Bank of Canada rate announcements?

- September 4 – (Interest rate announcement)

- October 23 – (Interest rate announcement and Monetary Policy Report)

- December 11 – (Interest rate announcement)

For more details about the 0.25% Bank of Canada rate cut, or to discuss which rate or product options might be right for you, please contact a member of the Outline Financial team as we are always on standby to help.