Great Mortgages. The Right Insurance. Expert Advice.

‘The likelihood of BoC pulling the trigger again has increased substantially’: How markets and economists are reacting to hot inflation data

The Globe and Mail – Sept 2023

Stronger-than-expected August inflation data this morning have markets and economists reassessing the odds of further policy moves by the Bank of Canada.

Canada’s annual inflation rate in August jumped to 4.0% from 3.3% in July on higher gasoline prices, while two of the three core inflation measures also rose, Statistics Canada said. Analysts polled by Reuters had forecast inflation would hit 3.8%. Month-over-month, the consumer price index rose 0.4% compared to a predicted 0.3% gain.

The August rate, the highest since the 4.4% in April, is well above the Bank of Canada’s 2% target.

Money markets were not positioned for such a hot inflation number. Canadian bond yields shot up immediately, with the five-year bond yield – influential on where fixed mortgage rates are set – rising 15 basis points to a fresh 16-year high of 4.2%. The Canadian dollar extended gains from earlier in the morning and at last check was up about half a cent against the greenback, a six-week high.

Credit markets quickly priced in stronger odds that the Bank of Canada may again hike its trend-setting overnight rate to combat inflationary pressures. Implied probabilities in swaps markets suggest about a 40% chance that the BoC will hike rates again at its next policy meeting on Oct. 25. Markets were only pricing in about a 21% chance of another quarter-point hike prior to the 0830 am ET data release.

By December’s BoC policy meeting, swaps markets are now pricing in better-than-50% odds that the overnight rate will be higher than it stands today. And by early 2024, they are fully pricing in a quarter-point rate hike. For 2024 as a while, swaps markets are pricing in little chance of any BoC rate cuts materializing.

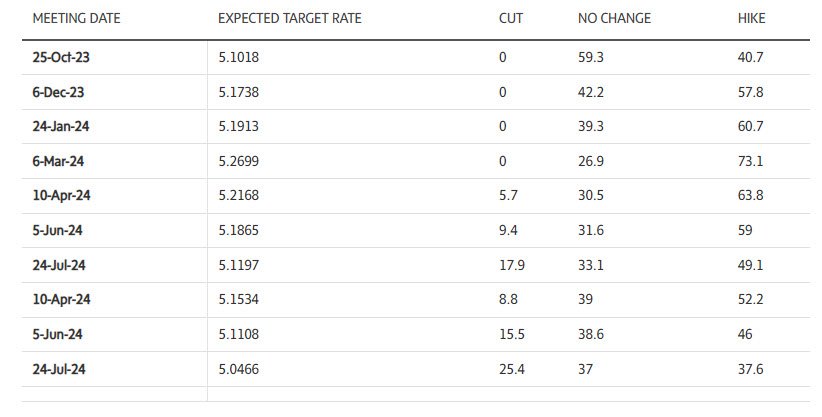

The following table details how money markets are pricing in further moves in the Bank of Canada overnight rate, according to Refinitiv Eikon data as of 1045 am ET. The current Bank of Canada overnight rate is 5%. While the bank moves in quarter point increments, credit market implied rates fluctuate more fluidly and are constantly changing. Columns to the right are percentage probabilities of future rate moves.

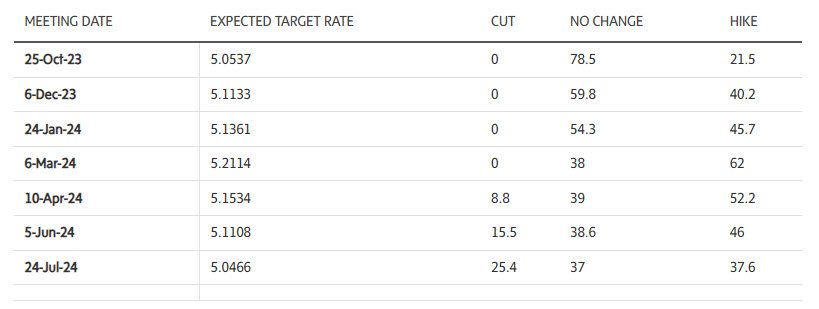

Here’s how the swaps pricing looked just prior to the inflation report:

Here’s how economists are reacting:

Matthieu Arseneau and Alexandra Ducharme, economists with National Bank Financial

For the second month running, inflation came in well above economists’ consensus expectations. It would be an understatement to say that progress towards returning inflation to target has stagnated this summer. It was an open secret among economists that progress would be held back by unfavourable base effects (the price of oil had fallen substantially over the course of last summer). But the acceleration in prices is compounded by the fact that oil prices are rising as major oil producers reduce supply. But the resurgence of inflation in Canada this summer is not confined to energy. From July to August, all 8 major categories were rising at an annualized rate above the Bank of Canada’s target, a third occurrence in three decades. The widespread nature of price rises is also reflected in the core inflation measures favored by the central bank. Both CPI-Trim and CPI-Median increased 0.44% m/m, the average of the two being the strongest since May 2022. On a three-month annualized basis, the average of the two core measures now stands at 4.5% after evolving in the 3.5%-4.0% band since last August, a situation that was already making the central bank uncomfortable.

However, it is interesting to note that other measures of underlying inflation are evolving at much less worrying pace. Indeed, still on a three-month annualized basis, CPI excluding food and energy and the CPI excluding the eight most volatile components are rising by 3.6% and 3.2%, respectively. This morning’s report presents the Bank of Canada with a complex dilemma. Inflation is accelerating at the same time as the Canadian economy is starting to bend its knees, which should ease inflationary pressures with some delay, especially with a less tight labor market. We are also comforted by the fact that deflation in China could mean weak goods inflation in 2024. Given the lag in transmission and the extremely restrictive level of monetary policy, we still believe that further rate hikes are perilous. However, given the Bank of Canada’s hawkish bias, the likelihood of it pulling the trigger again increased substantially this morning.

Derek Holt, vice-president & head of Capital Markets Economics, Scotiabank

Inflation’s cooling, they say. It’s only gasoline and mortgage interest costs that are driving it, they say. The government’s (rather unclear) ‘plan’ is working, they say. The Bank of Canada is obviously done raising rates, they say. All of which is complete, utter, rubbish. Another ripping inflation report put an exclamation point behind rebutting each of these claims. The Bank of Canada has a severe credibility problem on its hands amid the high risk that further tightening may yet be required. ….

Key here is that the higher frequency evidence of underlying inflationary pressures continued to take off last month particularly in terms of the BoC’s most preferred measures. Weighted median and trimmed mean CPI both accelerated to 5.4% m/m at a seasonally adjusted and annualized rate. … The breadth of the price pressures is astounding and it picked up in August. 52% of the CPI basket is up by 4% m/m SAAR [seasonally adjusted annual rate] or more (from 43% prior) and 64% is up by 3% or more (from 52% prior). …

Pending further data, this definitely ups the odds of a rate hike at the October meeting. Barring major developments by then I would forecast a hike but I don’t want to pre-commit to that view just yet given that there is a lot of ground to cover between now and the decision on October 25th. We’ll get another CPI inflation report plus another batch of data on jobs and wages and another round of BoC’s surveys of consumers and businesses including measures of inflation expectations. Other domestic data and developments plus external influences will also be considered.

But if the BoC had to make a decision today, then I would say hike. A counter to this is to ride out the lagging effects which is an argument that I’ve never bought in this cycle, nor have I believed the narrative that inflation is transitory versus a multi-year structural issue. Riding out policy lags is a luxury drawn from past cycles when the wages and prices complex was not adjusting in such rapid fashion and feeding upon itself. Riding out lags and counting upon forward guidance to be high for longer is another luxury drawn from an era before the credibility of providing longer-term forward guidance became thoroughly destroyed by broken promises not to raise rates for years. It is unsuited to today’s circumstances.

In today’s climate, surging inflation has very clearly unmoored inflation expectations as evidenced by those same BoC surveys that have consumers and businesses saying they think inflation will ride over 3% y/y throughout the years ahead. Surveying for the latest surveys is now over.

It’s also evident in wage setting exercises. Canada is different from the US with a 30% unionization rate that is triple that of the US. Collective bargaining has a similar influence upon Canada as in Europe and this is posing second-round inflationary pressures. We see that in average hourly wages that are up by 10–11% m/m SAAR in each of the past couple of months. We see it in the wage settlements data and with further strike risk to wage pressures ahead. Also recall IMF research that shows that countries with higher unionization rates and full employment conditions are more likely to see collective bargaining settlements stamped across the rest of the labour market. Canada meets both criteria. This summer and Fall it’s civil servants, port workers, education sector employees, and auto workers among others. Next it’s everyone else.

The combination of no one believing in the 2% inflation target, accelerating wage gains, ongoing collective bargaining pressures and tumbling labour productivity continues to put out of sample pressures upon underlying inflation. Out of sample immigration pressures add to this.

Royce Mendes, managing director & head of macro strategy, Desjardins Securities

The acceleration in the Bank of Canada’s core median and trim measures have shocked traders this morning, but the details aren’t necessarily as concerning. The pick up in both of those measures was largely driven by an increase in core goods price inflation. Indeed, the three-month annualized rate of core services excluding shelter inflation actually decelerated a touch. ….

Excluding food and energy, prices rose 0.3% seasonally-adjusted. Mortgage-interest costs were once again a big driver of the strength. Consumers did, however, receive some discounts on travel, with airline fares and travel tours prices down in August. Looking through all of this volatility, the underlying trend in prices was still hotter than anticipated.

The average of the three-month annualized rates of the Bank of Canada’s core trim and median measures now stands at 4.5%, up significantly from the 3.5% seen in July. Moreover, 50% of the CPI basket is still rising at a pace faster than 5% per year. Those statistics won’t sit well with the Bank of Canada. In response, Government of Canada bond yields are up sharply across the curve.

That said, the central bank is unlikely to change course based on one reading. There continue to be signs that the economy is stagnating even though the lagged impacts of monetary policy have yet to make their way through the system. As a result, expect policymakers to remain hesitant about raising rates any further this cycle even if they continue to talk tough. …

Each month that passes, roughly 2% of mortgage holders face renewal at sharply higher interest rates. The heavy debt load Canadians carry makes that a daunting prospect for policymakers. So while the central bank’s communications will likely remain fairly hawkish, the market reaction to today’s data looks overdone to us.

Stephen Brown, deputy chief North America economist, Capital Economics

The larger rise in core prices in August is bad news for the Bank of Canada although, with high interest rates now clearly weighing on the economy and another CPI report due before the next policy meeting in October, it is too soon to conclude that the Bank will need to hike again. …

The rise the headline and core inflation back toward 4% means we can no longer blame mortgage interest costs for keeping inflation elevated, as that component is currently adding little more than 1%-point to the headline rate. We estimate that headline inflation will average 3.7% this quarter, well above the Bank’s July forecast of 3.3%. While that means the Bank will maintain a hiking bias in its forthcoming communications and the risk of another rate hike is higher than we previously judged, we still think signs of broader economic weakness will persuade the Bank to remain on hold at its next meeting in October – providing that the September CPI report, due before that meeting, does not show another unwelcome surprise.

Douglas Porter, chief economist, BMO Capital Markets

After gasoline, the two biggest drivers of this high-side reading were mortgage interest costs (up 2.7% m/m and now up 30.9% y/y), and rent (+0.7% and 6.5% y/y). Combined with strength in some utilities costs, the overall shelter component rose at a piping hot 0.8% m/m, lifting it 6.0% above year-ago levels. Aside from food, that’s the fastest rising major component. The one sliver of good news here was that grocery prices actually dipped 0.4% in the month, pulling the annual increase down to 6.9% (from 8.5%), the calmest pace since the start of 2022. While gasoline prices were the biggest swing factor in today’s result, they were zero surprise at up 4.6% m/m, and now up a touch from year-ago levels. The bad news is that here in September, they are now running at more than 10% above year-ago levels, so next month’s headline reading is likely going higher.

After briefly boasting the lowest inflation rate in the G7 (at 2.8% in June), Canada is now running above Japan and the U.S. pace, at least on the headline. The early read on September inflation isn’t great either, as the base effects remain challenging (prices rose by just under 0.1% a year ago) and energy prices remain on the march.

Bottom Line: Things just got a lot more interesting for the Bank of Canada, and most definitely not in a good way. We all knew that the extended back-up in gasoline prices was going to be a headache for headline CPI and inflation expectations, but the inconvenient truth is that core has suddenly heated up as well. We will note that even excluding mortgage interest costs, prices are now up 3.2% y/y, or above the target band. There’s still lots of data to go before the Bank next decides on rates (October 25), including another swing at the CPI. Unfortunately, we suspect that with oil firing higher and core inflamed again, that report will be no better than today’s—second verse, same as the first, a little bit louder and likely a little bit worse.

Andrew Grantham, senior economist with CIBC Capital Markets

In the near-term, inflation is more likely to accelerate slightly further than decelerate, given the further increase in oil prices seen so far in September. For the third quarter as a whole, inflation is likely to average around 3.8%, well ahead of the 3.3% forecast from the Bank of Canada’s July MPR. While that’s partly because the July projection was based on WTI oil prices of $75/bbl (well below current levels), underlying inflationary pressures are also firmer than the Bank was probably expecting, meaning that policymakers will face some tough decisions at upcoming meetings. If consumer spending remains sluggish and the unemployment rate continues to grind higher as we forecast, we still expect that the Bank will refrain from further interest rate hikes despite the strong current inflationary backdrop.

Leslie Preston, managing director and senior economist, TD Economics

Headline inflation moving back up to 4% on higher energy prices would likely be tolerated by the Bank of Canada. But, core inflation measures heating back up to 4% y/y, and 4.5% on a three month annualized basis is going to ring some alarm bells at the Bank.

August’s inflation reading stands in contrast to other measures that have shown momentum cooling in Canada’s economy. The housing market, and new home construction cooled in August, and the unemployment rate has risen half a percentage point over the past few months. Fortunately, the Bank of Canada will see another inflation report before it’s next rate decision on October 25th. We expect further signs of slowing will help the Bank to continue to stand on the sidelines. However, today’s inflation report has raised the odds they may need to make another move.

Pierre-Benoît Gauthier, assistant vice-president of investment strategy at IG Wealth Management

Not only did last year’s soft numbers create a “base effect” that led to a predictable year-over-year increase, the month-over-month figures also heated more than expected. But we couldn’t call it especially surprising, as anyone who puts gas in their car weekly might’ve guessed. Because yes; this uptick is mainly due to soaring energy prices. When you take energy out of the equation, the annual inflation rate stays flat at 4.1%. However, rising gasoline prices aren’t working alone; the Bank of Canada is adding its own kind of fuel to the fire by causing housing costs to rise due to mortgage interest costs.

After the data was released, yields went up, signaling that the markets see this higher-than-expected number as a danger that could prompt action from the Bank of Canada. Despite these warning signs, we believe that indications of a softer economy will likely prevent the BoC from implementing further interest rate hikes. … The increase in gasoline prices is likely to reduce discretionary spending in other areas, potentially mitigating some inflationary forces. But that’s really reaching for a silver lining.”

Tiffany Wilding, managing director and economist with investment management firm PIMCO

Overall, August’s CPI report raises the odds the Bank of Canada feels the need to add additional monetary policy tightening at the upcoming meetings. Their preferred core inflation measures have not made meaningful progress this year and are now moving in the wrong direction, while wage inflation continues to remain robust even as the labor market loosens. However, the next meeting does not come until October 25th, meaning there is plenty more data to be received beforehand, including another CPI report.

The Bank of Canada faces a tough conundrum, in that it must balance weak growth and loosening labour markets against still elevated wage and price inflation. Altogether, we think the odds of an October rate hike have increased sharply following today’s report and the onus is likely on the September CPI report and Labour Force Survey to show a deceleration in both price and wage inflation in order to avoid the BOC coming back off the sidelines for the second time this year.

David-Alexandre Brassard, chief economist for Chartered Professional Accountants of Canada

Headline inflation has crept up in August due to higher energy prices. Excluding this volatile component, prices have slightly increased (+0.1%) from July to August. Service inflation has stabilized, and food prices went down for the first time in more than two years. Inflation must still come down, but there is little sign of generalized sustained inflationary pressure. This should reinforce the Bank of Canada’s recent decision to pause interest rate increases. Shelter-related costs have increased significantly and are showing no signs of stopping, which will put even more political pressure on housing.

Jay Zhao-Murray, forecast analyst at Monex Canada, a foreign exchange firm

While the Bank of Canada could have chalked this down to higher gasoline prices given that they ripped 4.6% higher in August alone, the renewed uptick in their favoured underlying measures of core inflation means that the second pause in their hiking cycle this year is under threat. While back in June it was the strength in growth conditions that led the BoC to resume hiking rates twice more to a level of 5%, now it is the uptick in the previously stagnant core inflation metrics. Both the 3-month annualised averages of core-trim and core-median rose by a full percentage point in August to 4.6% and 4.4% respectively, breaking the 4% upper bound that these measures had held since November. It is still too early to confidently call for another BoC hike in the fourth quarter given the slightly negative GDP reading for Q2, signs that the labour market is recalibrating, less hawkish commentary from Governor Macklem at the last BoC meeting, and the fact that there is still one more inflation report before the October meeting. But the worrying surge in core price pressures means that our view that the Canadian policy rate had peaked is now under credible threat.

Nathan Janzen, assistant chief economist, RBC Economics

The economic backdrop has been showing clear signs of slowing (with a decline in GDP in Q2 and drift higher in unemployment in recent months.) And that should signal that inflation pressures will ease going forward. But the BoC has one mandate, and that is to target a 2% inflation rate. And the August CPI data took a significant step away from that target rather than towards it. We expect the economic backdrop will continue to soften, and don’t look for more interest rate hikes this year. But the central bank won’t hesitate to hike interest rates further if inflation pressures don’t show signs of easing.