In this year-end edition of the Mortgage Market Outline, we crown our “mortgage newsmaker of the year” and preview key trends and issues that could have a significant impact on 2023.

In summary, this detailed report covers the following:

• 2022 Top Mortgage Newsmaker of the Year

• 2023 Rate Forecast and Direction

• 2023 Economic Calendar – Dates to Watch!

• OSFI Reviews Further Policy Tightening Measures

• Potential Impact of Policy Tightening

• Strategies to Help Weather the Interest Rate Storm

2022 Newsmaker of The Year

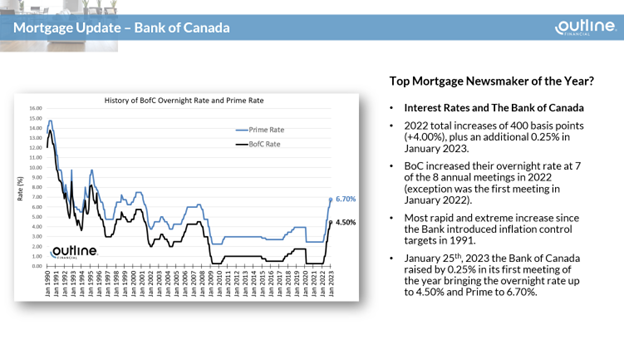

It comes as no surprise, but this year’s newsmaker of the year is the Bank of Canada. In 2022, the Bank of Canada (BoC) increased their overnight rate by 400 basis points (+4.00%) in total. This took the overnight rate from 0.25% in March 2022 all the way up to 4.25% by the end of the year. (Note: in the below chart we also include the most recent 0.25% BoC increase on January 25, 2023 bringing the overnight rate to 4.50%).

The federal banks/lenders followed course by raising their prime rates from 2.45% in March 2022 up to 6.45% by the end of the year. (Note: in the below chart we also include the 0.25% BoC rate increase on January 25, 2023 bringing prime rate up to 6.70%).

This series of successive rate increases was the most rapid and extreme since the Bank of Canada introduced inflation control targets in 1991.

2023 Rate Forecast & Direction

What do we expect from a rate perspective heading into 2023?

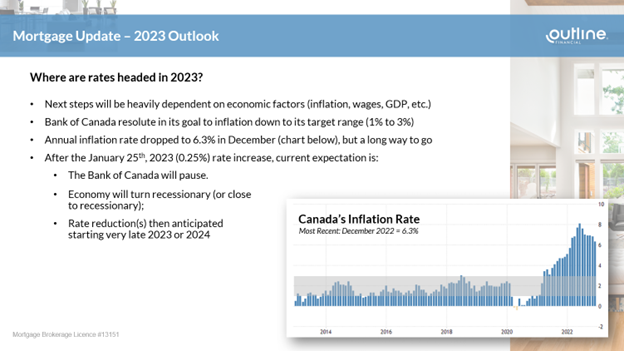

The Bank of Canada has been very clear that the direction and timing of future rate changes will be heavily dependent on economic factors such as inflation, wages, GDP, etc. The Bank of Canada is resolute in its goal to bring inflation down to its target range of 1% to 3%.

How far are we from this target range? As illustrated on the next page, the most current measure of inflation* was 6.3% in December 2022. While this was down from the 6.8% mark hit in November, and we are headed in the right direction, we still have a long way to go.

With respect to next steps from the Bank of Canada, we anticipate the following:

- An additional 0.25% increase by the Bank of Canada at their first meeting on January 25, 2023 bringing the target overnight rate to 4.50% (and prime rate to 6.70%).

- We expect the Bank of Canada will then pause to assess the economic impact of its cumulative increases (the BoC will have increased their target overnight rate by 4.25% over a 12-month period).

- We expect the economy will turn recessionary, or close to recessionary, in mid to late 2023.

- The Bank of Canada will respond by stepping in and lowering their target overnight rate starting in early 2024.

- How far and how fast will the BoC decrease rates in 2024? Only time will tell, however, at the time of writing, the big 6 banks are generally forecasting that the target overnight rate will fall to 3.00% by the end of 2024.

*The rate of inflation is measured using the Consumer Price Index (CPI). The CPI looks at a “basket” of goods and services that roughly represents what the average consumer purchases. Economists will compare the costs of this basket for one month vs. the same month a year earlier. The difference between the two is commonly known as the inflation rate.

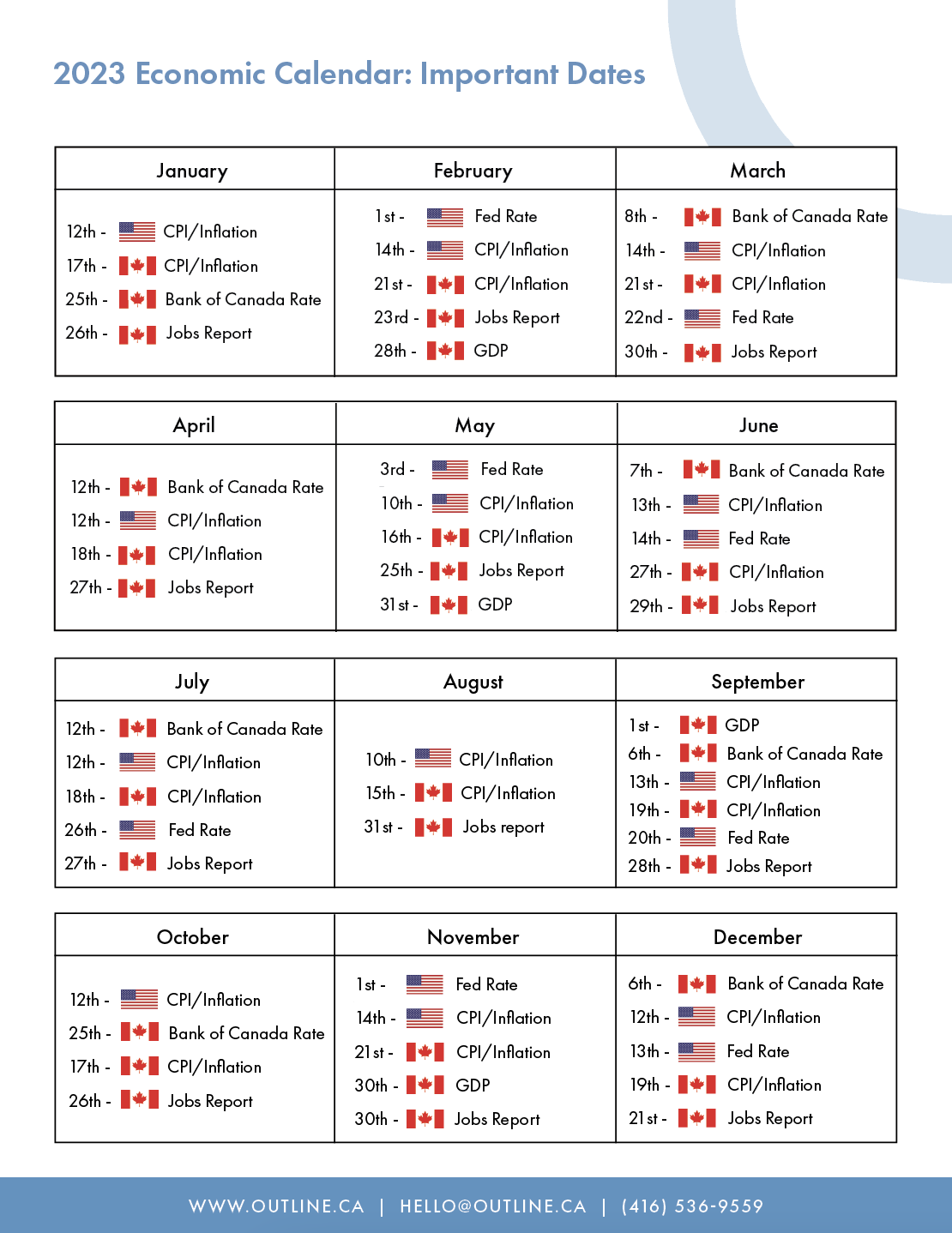

2023 Economic Calendar – Dates to Watch!

There’s no question 2022 was a volatile year. Inflation soared, rates rose, and we saw definitive impacts on our real estate market. As we enter 2023, our eyes are focused on how effective these rate increases will be on curbing inflation, while also watching for signs of an upcoming recession or normalcy (i.e., hard or soft economic landing).

With respect to what we are monitoring, we have put together an economic calendar with some of the key dates that could have a significant impact on fixed rates, variable rates, as well as our overall market.

While there are countless economic data points and release dates that have significant importance, we selected the following major categories to include on our calendar:

Bank of Canada Rate Announcement: 8 dates spread across the year where the Bank of Canada provides an update on the economy, and any updates to their target overnight rate. A change in the target overnight rate directly affects prime rate and variable rate mortgages, and could indirectly affect fixed rates if changes are different from market expectations.

Fed Rate (US) Announcement: Similar to the Bank of Canada Rate updates, the US Fed updates their Fed Reserve rate during 8 scheduled meetings during the year. Although there is not a direct link to our prime rates, changes by the US Fed will influence the Bank of Canada as well as fixed mortgage rates by impacting Canadian bond yield performance.

CPI/Inflation Report: These are monthly reports (US and Canada) on how inflation was for the previous month. Included in the report is a comparison to the previous month as well as the previous year. As mentioned in previous sections of the report, the Bank of Canada is unlikely to start lowering rates until inflation drops significantly. Fixed rates, however, could see downward trends if inflation cools faster or further in 2023 than current expectations.

GDP Report: This stands for Gross Domestic Product and is a measure of Canada’s economic performance. If we see growth cooling, this could mean we are headed for a recession, in which case we could see decreasing bond yields and therefore decreasing fixed mortgage rates. If GDP strengthens unexpectedly, this will likely mean a surge in bond yields and subsequently fixed rates could rise.

Jobs Report: These reports look at both unemployment and labour wage inflation. Labour wage is a key metric for future overall inflation and can have a significant impact on the Bank of Canada’s rate decisions (and therefore fixed and variable mortgage rate direction).

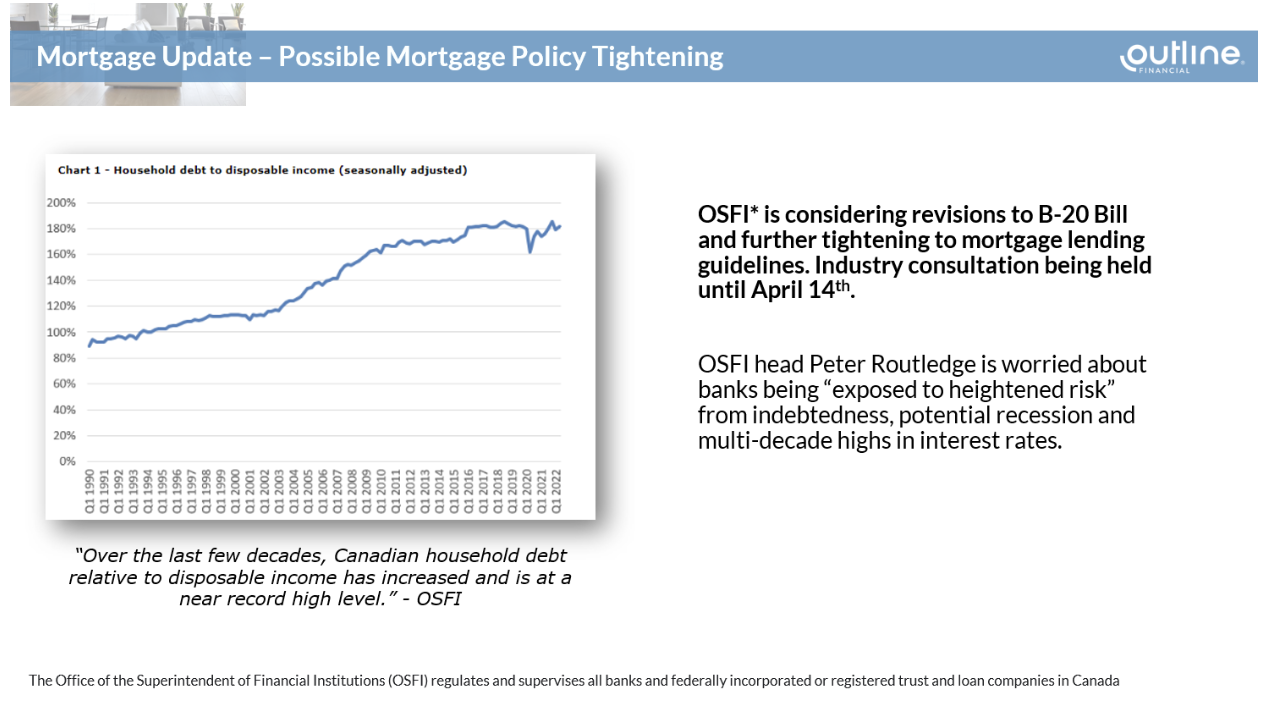

OSFI Considers Further Policy Tightening Measures

Taking many people by surprise, in January 2023, the Office of the Superintendent of Financial Institutions (OSFI) announced a public consultation of current B-20 Guidelines (rules that guide the residential mortgage underwriting practices and procedures at federally regulated banks) to address heightened near-term risks in the Canadian residential mortgage market.

As outlined in this section of the report, the proposed measures include:

1. Loan-to-income(LTI)restrictions

2. Debt service coverage restrictions, and

3. Interest rate affordability stress test amendments

OSFI is seeking stakeholder feedback on these proposed measures until April 14, 2023. The feedback will be used to draft amendments to B-20 which will then be issued for public consultation at a future date.

1. Loan-to-Income (LTI) Restrictions

What is a loan-to-income ratio (LTI ratio)? The LTI ratio is expressed as a multiple of income or a percentage equal to the total mortgage balance divided by the borrower’s annual income. A few examples are as follows:

- Example 1 – the bank issues a $300,000 mortgage to a borrower that earns $100,000 in annual income. The LTI ratio is equal to 3x or 300%.

- Example 2 – the bank issues a $500,000 mortgage to a borrower that earns $100,000 in annual income. The LTI ratio is 5x or 500%.

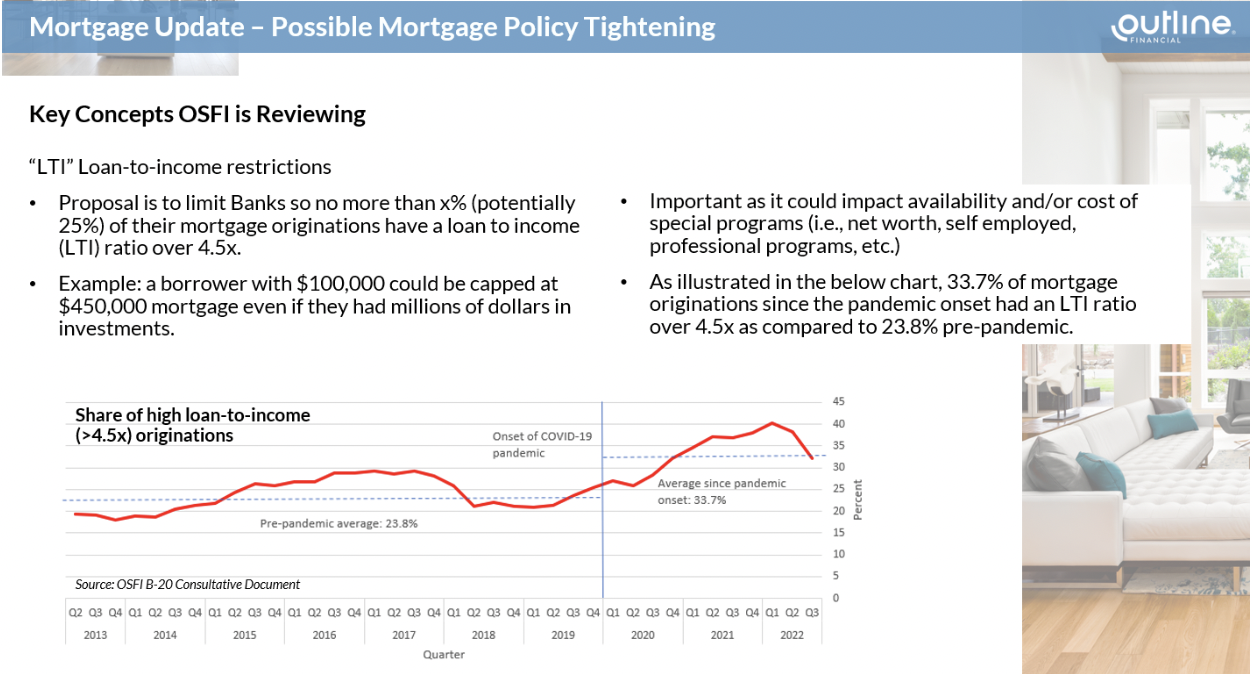

Currently, there are no specific LTI ratio caps for federally regulated banks, however, OSFI generally considers an LTI ratio of greater than 4.5x (450%) to be “high”. As illustrated in the below chart, the percentage of mortgage originations that had an LTI ratio greater than 4.5x (“high” LTI) grew from 23.8% pre-pandemic to 33.7% after the onset of the pandemic.

As part of its proposed restrictions, OSFI is considering:

- Implementing a clear and consistent definition of “income” for calculating LTI;

- Formally define a “high” LTI threshold as 4.5x (this could potentially fluctuate in view of different macroeconomic conditions).

- Implement a 25% quarterly volume limit on originations that exceed 4.5x LTI (i.e., no more than 25% of bank originated mortgages during a quarter can have an LTI ratio over 4.5x)

2. GDS / TDS Restrictions

As a refresher, the GDS (Gross Debt Service) and TDS (Total Debt Service) ratios are the affordability calculations used by a lender to qualify a mortgage. The GDS ratio is calculated as the monthly housing costs (mortgage payment, property tax, heat, plus 50% condo fees if applicable), divided by the borrowers’ monthly income. The TDS ratio is the same as GDS but adds other monthly carrying costs to the formula such as credit cards, car loans, student loans, etc.

For insured mortgages in Canada (mortgages with less than 20% down payment), GDS and TDS limits are prescribed by law and are currently set at 39% and 44%, respectively (although some lenders may decide to be more restrictive with their internal policies).

For uninsured mortgages, current B-20 Guidelines do not specify limits on GDS and TDS and leaves it up to the banks to implement prudent debt service metrics based on their RMUPs (residential mortgage underwriting policies).

OSFI is considering the following amendments:

- Add GDS / TDS definitions and formulas for uninsured mortgages,

- Add GDS / TDS limits which could be graduated or tiered based on risk,

- An explicit amortization limit used for qualification (note: the shorter the amortization, the more restrictive – i.e., 25 year vs. 30 year amortization).

3. Stress Test Amendments

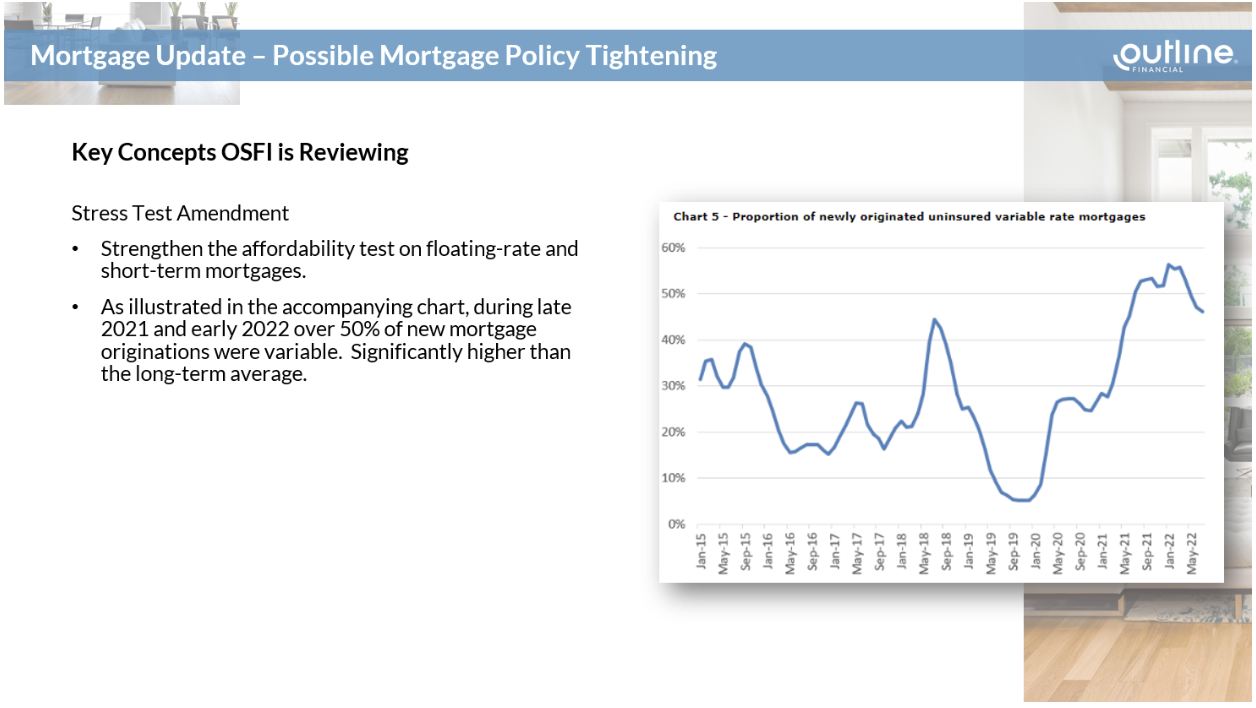

The third category of changes that OSFI is considering is with respect to the stress test (a.k.a. the MQR which stands for Minimum Qualifying Rate).

Currently, the MQR is used when calculating the mortgage payment for GDS and TDS ratios. As part of its annual review, on December 15, 2022, OSFI held the MQR steady, at the greater of 5.25% or the mortgage contractual rate plus 2%.

Changes OSFI is considering:

- Making the stress test harder for variable rate and/or shorter term fixed rate mortgages. As illustrated in the below chart, during late 2021 and early 2022, the percentage of variable rate mortgage originations (vs. fixed) climbed above 50%.

- Apply the MQR to a borrower’s total debt service (i.e., for other existing mortgages and non-mortgage debt obligations held by the borrower).

- Test of affordability and other debt serviceability measures for non-mortgage retail lending outside of B-20.

What’s next for OSFI?

While a more secure banking sector with lower exposure to risk is a good thing, many are concerned with the timing (and depth) of these OSFI proposals. Many Canadians are already in a position where their indebtedness has increased, rates have increased, and there is a looming recession. Couple that with several other housing related regulations coming into force in 2023 including:

- Prohibition on the Purchase of Residential Property by Non-Canadians (Foreign Buyers Ban) - Vacant Home Tax

- Anti-Flipping Tax on Residential Properties

Making it more difficult to access lower-cost capital in the current market conditions could have unintended consequences such as pushing people to provincial regulated lenders (i.e., credit unions*), or higher cost solutions, which could end up creating a different set of challenges in the long term. Only time will tell which of these OSFI proposals are implemented, and it will definitely be something we monitor closely.

*NOTE: OSFI is seeking stakeholder feedback on these proposed measures until April 14, 2023. The feedback will be used to draft amendments to B-20 which will then be issued for public consultation at a future date.

Possible Mortgage Payment Relief Measures

If a borrower is concerned they will miss one or more mortgage payments, it is important they take action right away, and BEFORE, they miss their payment(s). Ultimately, lenders/banks don’t want their clients to default, and they are often very willing to work out a custom solution to try and help.

What follows is a list of potential payment relief options that may be available:

- Requesting a payment pause from the lender/bank. These payment deferrals may be available, but will vary from bank to bank. It is important to talk to the lender/bank before a missed payment, as that could severely limit the available options.

- Request an amortization extension. By extending the mortgage amortization, you are spreading out the time it will take to pay off the mortgage, thereby reducing the monthly payments.

- Consider a debt restructure or consolidation. There may be options to consolidate or restructure existing mortgage and/or non-mortgage loans into an overall lower cost of borrowing.

- Combination products (combined mortgage and line of credit products). These products may provide some short-term payment relief, as you can draw from the line of credit to make the monthly mortgage payment. Some products can be set up to do this automatically.

- Reverse mortgages. Reverse mortgages have specific qualifying criteria, but require no ongoing payments. Instead, the monthly interest costs are added to the mortgage amount, which grows over time.

To discuss any of the above in more detail, please reach out to a member of the Outline Financial team at any time.

Outline Financial

Outline Financial is one of Canada’s top-rated mortgage and insurance companies offering direct access to rate and product options from over 30 banks, credit unions, mono-line lenders and insurers all in one convenient service. The Outline team was formed by senior level bankers and financial planners that wanted to offer clients choice with an exceptional service experience.

Contact

Tel: (416) 536-9559

Email: hello@outline.ca

Click here to book a call

Outline Financial – Toronto Head Office

465 King Street East – Suite 15

Toronto, ON M5A 1L6

Outline Financial – Toronto

326 Carlaw Ave – Suite 103

Toronto, ON M4M 2R6

Outline Financial – Ottawa

90 Richmond Rd – Suite H

Ottawa, ON K1Z 6V9

Outline Financial – Calgary

330 – 5th Avenue SW, Tower 1, Suite 1800

Calgary, AB T2P 0L4

Outline Financial – Vancouver

701 West Georgia St, Suite 1500

Vancouver, BC Y7Y 1C6

Legal

FSRA Mortgage Brokerage Licence #13151

FSRA Life Insurance and Accident and Sickness Insurance Agent License #36641M