Great Mortgages. The Right Insurance. Expert Advice.

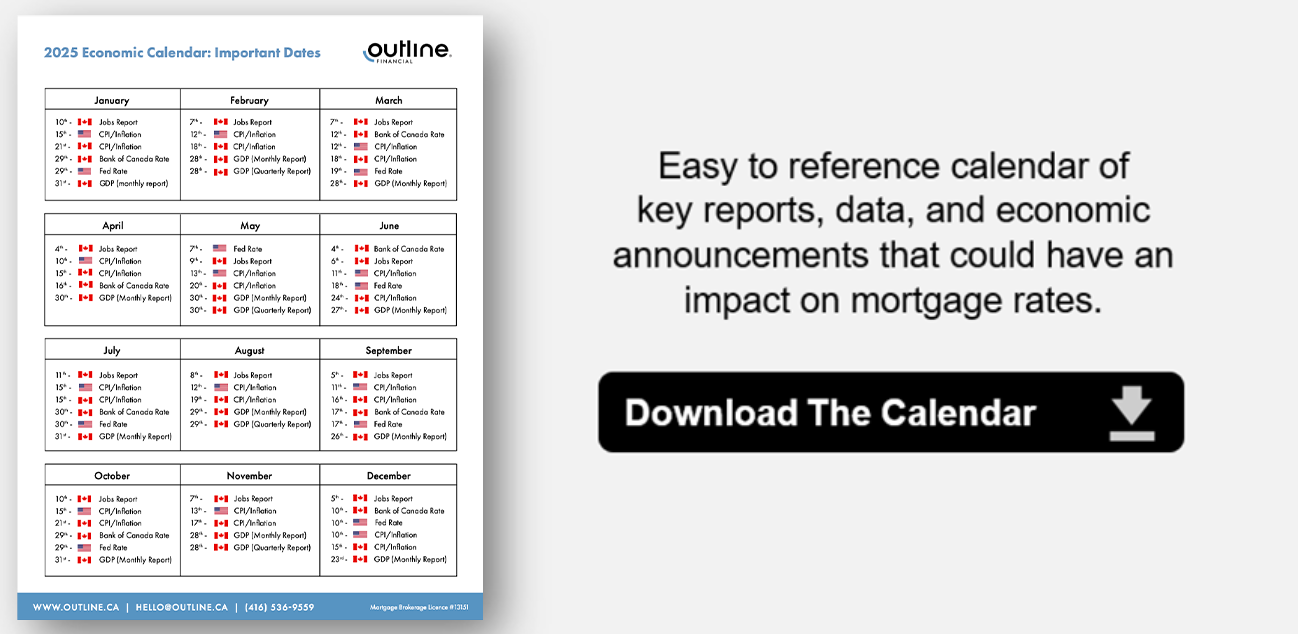

2025 Economic Calendar: Important Dates

Wondering where rates are headed in 2025? While no one has a crystal ball, there are specific dates throughout the year that can cause waves in the mortgage market. To help calm the waters, we’ve prepared a 2025 economic calendar with key dates of importance. While we haven’t included every date, we’ve tried to highlight the most impactful.

So what reports & announcement dates have we included, and how can they impact interest rates? Please refer to a quick summary below:

“Bank of Canada Rate” – Bank of Canada Meeting / Rate Announcement Dates:

The Bank of Canada meets 8 times spread across the year where they provide an update on the economy, and announce any updates to their Overnight rate. The Overnight rate directly affects the Prime rate and Variable rate mortgages, and could indirectly affect fixed rates if changes are different from market expectations.

“Fed Rate” – US Federal Reserve Meeting / Rate Announcement Dates

Similar to the Bank of Canada Rate updates, the US Fed updates their Reserve rate. Although there is not a direct link to our Prime Rates, changes by the US Fed will influence the Bank of Canada as well as Fixed rates by impacting Bond Yield performance.

“CPI / Inflation” = Consumer Price Index (Statistics Canada / US Bureau of Labor Statistics)

These are monthly reports on how inflation was for the previous month. Included is a comparison to the past month as well as the previous year. These occur in both Canada and the US. This is a key metric, where we the central banks want to see inflation come down to a certain range (target is 2% in Canada).

“GDP” = Gross domestic product, income and expenditure (Statistics Canada)

GDP stands for Gross Domestic Product, and is a measure of Canada’s economic performance. If we see growth cooling this may mean we’re headed for recession; in which case we may see bond yields drop potentially leading to lower fixed rates. If GDP strengthens unexpectedly, this will likely mean a surge in Bonds yields and subsequently fixed rates could rise.

“Jobs Report” = Labour Force Survey (Statistics Canada)

These reports look at both unemployment and labour wage inflation. Labour wage is a key metric for future overall inflation, and so the results could impact Bank of Canada decisions on whether sustained inflation-combating measures are needed or not.

We hope you find the above information and the calendar helpful. Should you have any questions, please don’t hesitate to reach out to an Outline Financial mortgage agent to discuss.